Ever tried to stick to a budget only to realize your coffee addiction alone sabotaged the entire plan? Yeah, we’ve been there. Whether you’re juggling student loans or trying to save up for that dream vacation, managing expenses manually feels like herding cats. What if I told you there’s an easier way—using automated expense tracking tools specifically designed for people taking budgeting courses?

This post isn’t just another sales pitch for fancy apps; it’s your guide to mastering automated expense tracking while leveling up in your personal finance education. Here’s what you’ll learn: Why automation matters, how to pick the right tool, and actionable tips to stay on top of your game without losing sleep—or your sanity.

Table of Contents

- Why Does Automated Expense Tracking Matter?

- 3 Steps to Get Started with Automated Tools

- 5 Best Practices for Using These Tools

- Real-Life Wins: How Others Crushed Their Budgets

- FAQs About Automated Expense Tracking

Key Takeaways

- Automated expense tracking saves time and reduces human error.

- Budgeting courses often integrate well with these tools for real-world practice.

- Pick tools that sync seamlessly with your bank accounts and offer customizable features.

- Consistency beats perfection when it comes to using automated systems effectively.

Why Does Automated Expense Tracking Matter?

Let me confess something embarrassing: Once upon a time, I spent three hours sorting receipts by hand after finishing a budgeting course. Three. Whole. Hours. And then my cat knocked over a glass of water onto my painstakingly organized spreadsheets. That was the moment I realized manual budgeting practices were officially dead to me.

Sounds dramatic? Maybe. But here’s a stat that isn’t: The average person underestimates their monthly spending by about 30%. If you’re learning through a budgeting course, this blind spot can derail everything you’re working toward. Enter automated expense tracking. It eliminates guesswork, categorizes transactions instantly, and lets you focus on bigger financial goals instead of drowning in Excel sheets.

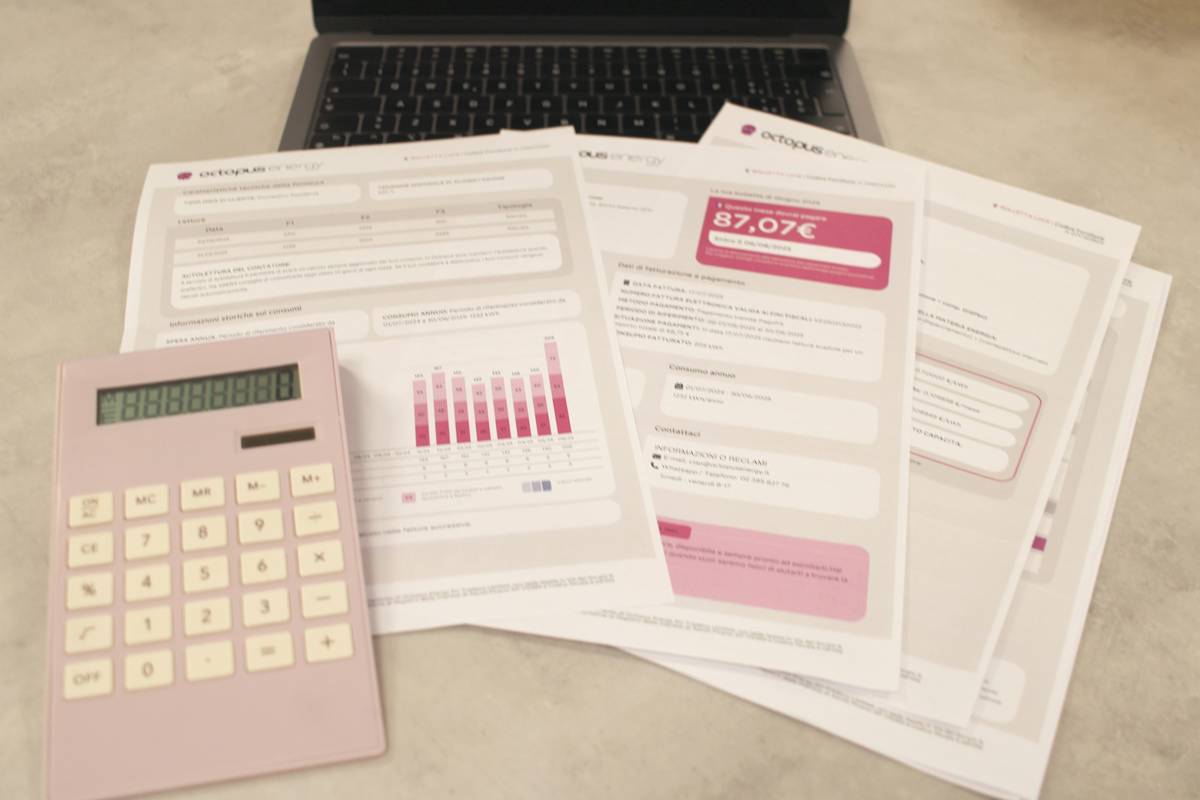

![]()

Optimist You: “Hey, maybe I could finally master my finances!”

Grumpy You: “Yeah, sure—but not before my third cup of coffee. Bring snacks too.”

3 Steps to Get Started with Automated Tools

Step 1: Connect Your Accounts Without Freaking Out

Okay, hear me out. Linking your bank account to an app sounds scary AF at first, but reputable platforms use encryption so secure even James Bond couldn’t hack them. Look for names like Mint, YNAB (You Need A Budget), or PocketGuard—they’re trusted options recommended in many budgeting courses.

Step 2: Customize Categories That Actually Make Sense

A one-size-fits-all approach rarely works. For instance, does your course classify ‘entertainment’ as Netflix AND concert tickets? Nope. Adjust categories based on your actual habits because life doesn’t fit neatly into preset boxes.

Step 3: Set Reminders & Alerts

Here’s where tech truly shines. Instead of waiting until payday to panic about overspending, get alerts when you’re close to hitting limits. Think of it as having a virtual accountability buddy whispering, “Um, hello? Lay off the Amazon shopping already.”

5 Best Practices for Using These Tools

- Daily Check-Ins: Spend five minutes reviewing updates daily—it’s less painful than binge-watching bad reality TV.

- Sync Regularly: Avoid surprises by ensuring all transactions are updated in real-time.

- Use Visual Reports: Pie charts FTW! Seeing visuals helps you understand where your money really goes.

- Don’t Ignore Anomalies: Random $50 charge from WhoKnowsWhatCo? Investigate immediately.

- Combine with Education: Pair automated tracking with lessons from your budgeting course to reinforce good habits.

Real-Life Wins: How Others Crushed Their Budgets

Jessica, a recent graduate, enrolled in a budgeting course last year. She paired her newfound knowledge with Mint’s automated expense tracking feature. Within six months, she reduced her dining-out costs by 40% simply because the app flagged every impulse taco run. Meanwhile, Mark used YNAB alongside his online classes and paid off $10,000 in debt within two years.

Chef’s kiss for combining strategy with execution, right?

FAQs About Automated Expense Tracking

Q: Is Automated Expense Tracking Safe?

Absolutely—as long as you stick to trusted platforms. Encryption technology keeps your data safer than hiding cash under your mattress.

Q: Can I Use This Alongside My Budgeting Course?

Totally! Many courses encourage integrating tools like these for practical application.

Q: What’s a Terrible Tip to Avoid?

Rely solely on automation without reviewing results. No tool replaces human oversight completely!

Q: Do I Need Multiple Apps?

Nope. Stick to one reliable option unless you want to confuse yourself more than necessary.

Conclusion

So, are you ready to let technology do the heavy lifting while you ace your budgeting course? With automated expense tracking, you can cut back on tedious tasks and actually enjoy staying financially responsible. Remember: Progress > Perfection. So grab that coffee, fire up your favorite app, and start slaying those budgets.

And hey—like a Tamagotchi needing constant care, your finances thrive best with attention. Don’t forget to nurture them regularly.

Numbers dance freely,

Expenses tracked, stress fades—

Peace at last, wallet.