“Ever stared at your bank account, wondering where all your money disappeared? Yeah, we’ve been there.”

Budgeting courses are great tools to improve financial literacy, but without a solid expense tracking system, even the best financial strategies can feel like guesswork. Whether you’re taking budgeting courses to save for a dream vacation or just trying to stop overspending on coffee runs, an effective expense tracking tool is essential for success.

In this post, you’ll learn:

- The real reason why most people fail at budgeting (and how an expense tracking system fixes it).

- A step-by-step guide to choosing the perfect system for your needs.

- Tips to maximize your results with minimal effort.

- Real-life examples of folks crushing their budgets—plus one hilarious fail story from yours truly.

Table of Contents

- Key Takeaways

- Why an Expense Tracking System Matters

- How to Choose the Right Expense Tracking System

- Tips & Best Practices to Use It Effectively

- Examples of People Who Nailed Their Budgets

- Frequently Asked Questions About Expense Tracking Systems

- Conclusion

Key Takeaways

- An expense tracking system helps you see exactly where your money goes, making budgeting easier and more effective.

- Different systems cater to different lifestyles—find what works best for YOU.

- Automating expense tracking minimizes errors and saves time.

- Even if you think you suck at budgeting now, the right tools make all the difference.

Why Does an Expense Tracking System Matter?

If I had a dollar for every time someone told me they were “bad” at budgeting… well, I wouldn’t need a budget!

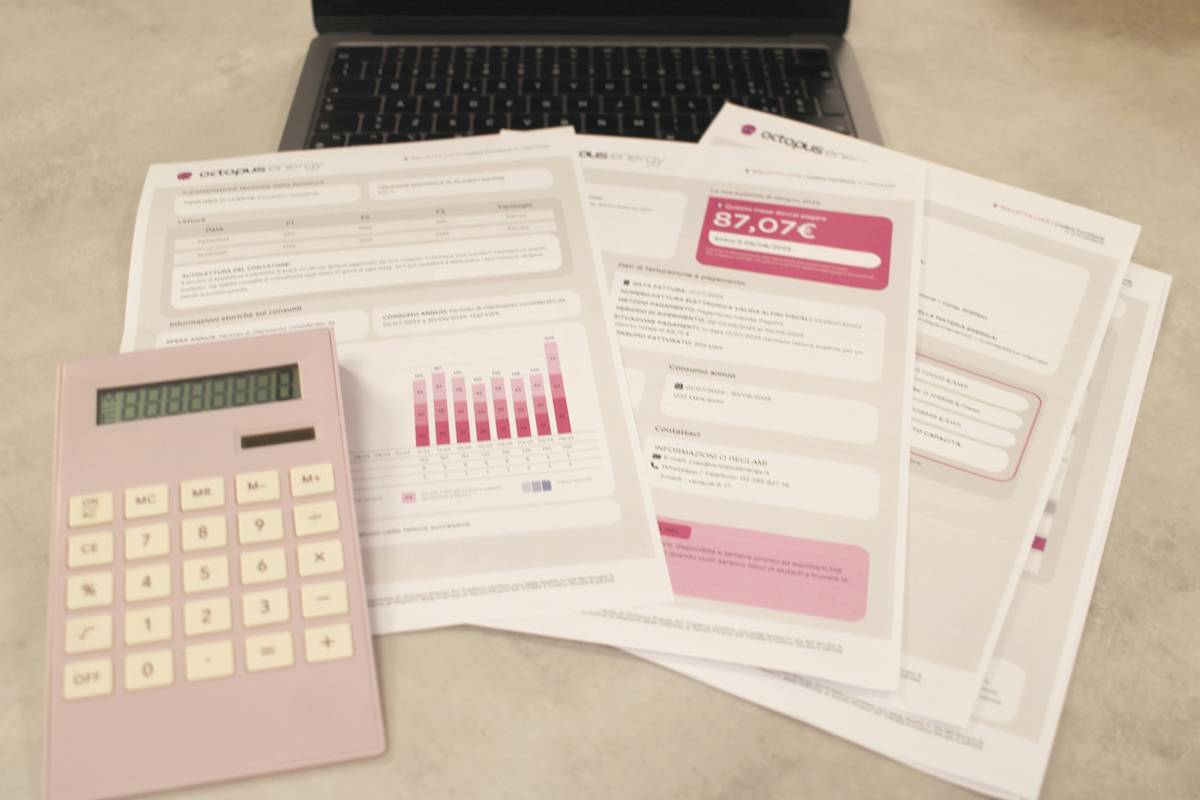

Here’s the truth: Nobody is inherently bad at managing finances. They’re just missing the magic ingredient—an expense tracking system. Without it, budgeting becomes guesswork. And guesswork leads to stress, missed goals, and that sinking feeling when bills pile up.

I once tried sticking to a handwritten notebook method—because #millennialminimalism, right? Big mistake. By week two, I’d forgotten my gym membership fee, accidentally double-counted groceries, and ended up ordering pizza instead of cooking because “my budget was ruined anyway.” RIP.

“Optimist You”:

“With a reliable expense tracker, budgeting courses become actionable plans—not wishful thinking!”

“Grumpy Me”:

“Ugh, fine. But only if it doesn’t involve spreadsheets.”

How to Choose the Right Expense Tracking System

Now let’s dive into how you can pick a system that complements your lifestyle while supporting those budgeting course lessons.

Step 1: Assess Your Needs

Are you tech-savvy or prefer pen-and-paper simplicity? Do you need something automatic for busy days? Ask yourself:

- Do I want automation or manual control?

- Am I okay sharing data across apps, or do I value privacy over convenience?

- Will I stick to a free app, or am I willing to invest in premium features?

Step 2: Research Tools

Popular options include:

- Mint: Free, easy-to-use dashboard; connects to your bank accounts automatically.

- You Need A Budget (YNAB): Paid app famous for its zero-based budgeting philosophy.

- Goodbudget: Envelope-style system designed for couples or families.

Step 3: Test Before You Commit

Download trials, read reviews, and test usability before fully committing. Remember, not every tool suits everyone!

Tips & Best Practices to Use It Effectively

Once you’ve chosen your expense tracking system, follow these golden rules:

- Categorize expenses immediately: Delayed entries lead to inaccurate totals.

- Set alerts: Notifications keep you accountable—you’ll thank yourself later.

- Review weekly: Regular check-ins prevent small mistakes from snowballing.

- Avoid shiny-object syndrome: Stick to ONE system instead of bouncing between apps.

*Terrible Tip Disclaimer: Don’t try manually inputting EVERY transaction retroactively—it’s soul-crushing and defeats the purpose of automation.

Rant Break:

Why do some tools insist on categorizing everything as “Other”? Seriously, developers—if I buy shoes, call it Clothing, not Mystery Spending. It’s infuriating. Like listening to nails on a chalkboard—but worse.

Examples of People Who Nailed Their Budgets

Meet Sarah, who paid off $20k of debt using YNAB after completing her budgeting courses. Her secret? Daily updates combined with strict adherence to categories. No excuses. Just cold, hard numbers. Chef’s kiss.

On the flip side, my friend Dave swore he could “track mentally” until he realized his “mental math” somehow forgot $500 worth of online shopping last month. Lesson learned: Humans ≠ calculators.

Frequently Asked Questions About Expense Tracking Systems

Q: Can I use Excel as my expense tracker?

Absolutely! If you love customizing formulas, go wild. However, expect higher maintenance compared to apps.

Q: Is sharing my info with third-party apps safe?

Most reputable tools encrypt your data, but research their security policies first. Privacy should always come first.

Q: What’s the worst thing that happens if I skip tracking?

No judgment here, but skipping expense tracking usually ends in surprise overdraft fees—or worse, no savings left by month’s end.

Conclusion

Your journey toward financial freedom starts today—with a kickass expense tracking system. Pair that with knowledge from budgeting courses, and you’ll be unstoppable. Optimist You says, “Go crush those goals!” Grumpy Me whispers, “Okay, okay—but bring snacks.”

And remember: Even Tamagotchis needed daily care back in the day. Treat your finances the same way!

Haiku Time:

Track dollars and cents,

Dream bigger than paychecks.

Budgeting unlocks.