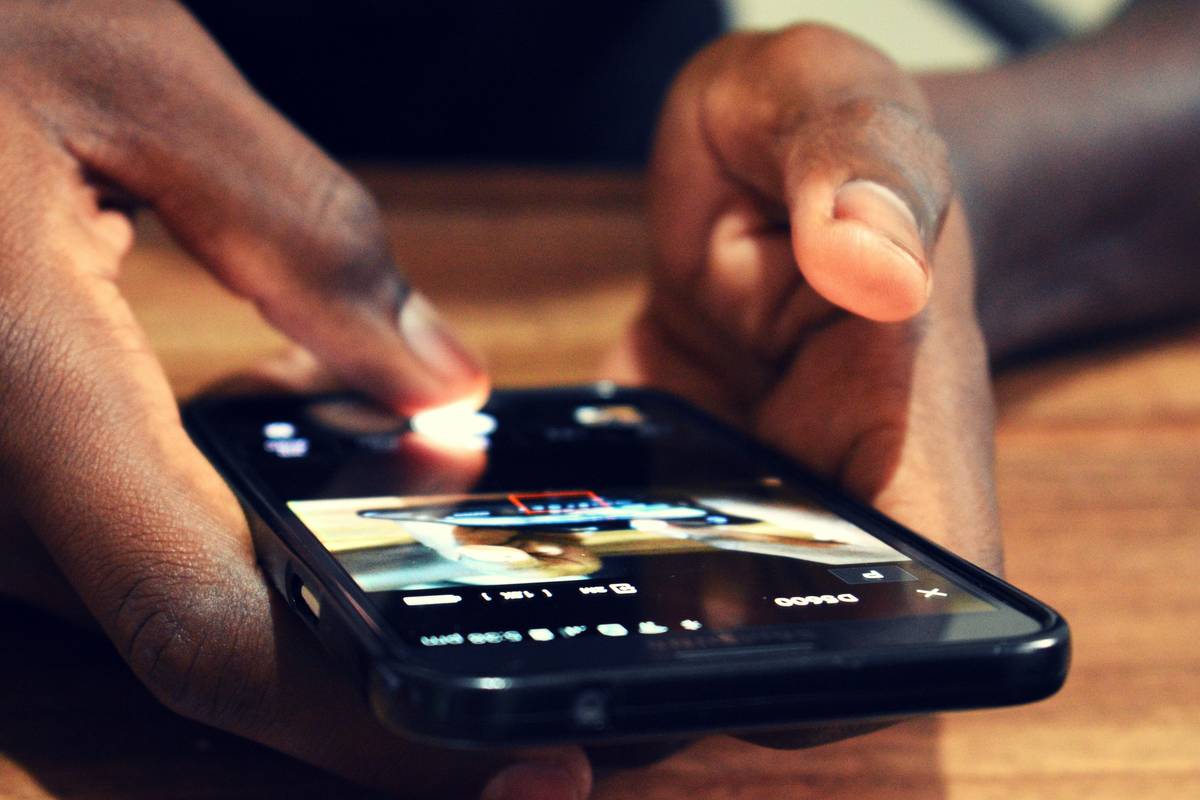

Ever stared at your phone bill, wondering where all that money went? Yeah, us too. If you’re nodding along, it might be time to get serious about mobile expense tracking. Not only can this practice save you cash, but it also lays the foundation for smarter financial habits. In this post, we’ll unpack how budgeting courses—specifically those focusing on mobile expense tracking—can revolutionize your personal finances. You’ll learn why tracking expenses matters, how to choose the right course, and tips to make your efforts stick.

TL;DR: Think of this as your crash course (pun intended) in mastering mobile expense tracking.

Table of Contents

- Why Mobile Expense Tracking Matters

- How to Choose a Budgeting Course

- Tips for Mastering Mobile Expense Tracking

- Real-Life Success Stories

- Frequently Asked Questions

Key Takeaways

- Mobile expense tracking helps identify unnecessary spending patterns.

- Budgeting courses offer tailored strategies for managing digital expenses.

- Pairing apps with education boosts accountability and financial clarity.

Why Mobile Expense Tracking Matters

Let’s talk about the elephant in the room: subscription fatigue. Have you ever subscribed to multiple streaming services, forgotten about them, and then ended up paying hundreds annually without even noticing? No judgment here—I once had three different music apps running simultaneously because I lost track of which one held my workout playlist. Sound familiar?

The truth is, our mobile devices have become extensions of ourselves. They store everything from grocery delivery charges to impulse buys during late-night scrolling sessions. Without proper oversight, these little transactions snowball into big surprises come payday. Add in hidden fees, roaming costs, or auto-renewals, and suddenly, *cha-ching* feels more like *ouch.*

How to Choose a Budgeting Course That Works for You

Finding the perfect budgeting course doesn’t need to feel like dating apps—it’s not a numbers game. Here’s how to pick one that aligns with your goals:

What Should You Look For?

Optimist You: “Just pick something cheap, quick, and easy!”

Grumpy You: “Ugh, fine—but only if coffee’s involved.”

- Focus on Mobile Expense Tracking Modules: Ensure the curriculum dives deep into monitoring tools, app integrations, and actionable insights specific to phones.

- Interactive Content: Check if they provide hands-on exercises, quizzes, or real-world application challenges.

- Community Support: Accountability buddies > solo journeys. Look for courses with forums or mentoring programs.

Tips for Mastering Mobile Expense Tracking

Alright, let’s dive into some pro-level advice:

- Automate Everything: Use apps like Mint, YNAB, or PocketGuard to categorize purchases automatically.

- Review Regularly: Set reminders to review your reports every week. It sounds boring, but consistency pays off.

- Prioritize Subscriptions: Cancel redundant subscriptions before adding new ones. Your wallet—and peace of mind—will thank you.

- Set Alerts: Many banking apps allow alerts when you exceed certain thresholds. Enable them!

A Terrible Tip Disclaimer

“Ignore small charges—it’s just $2 here and there!” Yes, we’ve all heard it. But trust me, those $2 lattes add up faster than Avengers sequels. Don’t fall for this myth.

Real-Life Success Stories

Jessica, a freelancer in Denver, took a budgeting course focused on mobile expense tracking after realizing her phone bills were eating 15% of her income. Armed with fresh knowledge, she cut down recurring charges by $80/month while renegotiating her data plan. She now uses the savings to invest in stocks. Talk about chef’s kiss transformation!

Frequently Asked Questions

What makes mobile expense tracking unique compared to traditional budgeting?

Traditional methods often overlook microtransactions tied to digital wallets or automatic renewals. Mobile-focused systems catch leaks earlier.

Do I really need a course to improve my spending habits?

No, but think of it as leveling up. A structured program keeps you accountable and saves trial-and-error headaches.

Which apps integrate well with budgeting courses?

Apps like Mint, Personal Capital, and Goodbudget sync seamlessly with most educational resources. Just ensure compatibility before enrolling.

Conclusion

Mobile expense tracking isn’t just a buzzword—it’s your ticket to financial freedom. With the right education and tools, you can turn overlooked phone expenses into savings opportunities. So why wait? Dive into a solid budgeting course today, start automating, and watch your stress levels (and bank account) stabilize.

And hey, remember—a watched debit card never boils.

Like dial-up internet, bad spending habits belong firmly in the past. Keep tracking, stay curious, and may your budgets forever be balanced.

Numbers tell their tale,

Expense trackers light the path,

Freedom waits ahead.