“Ever stared at your bank account wondering where $200 magically disappeared? Spoiler: magic had nothing to do with it.”

Whether you’re a budgeting newbie or an Excel spreadsheet wizard, mastering expense tracking monitoring tools can transform your financial health. And no, we’re not just talking about opening your banking app once a month and panicking. Today, we’re diving deep into the world of budgeting courses that teach you how to use these tools effectively. By the end of this post, you’ll have actionable insights on leveraging expense trackers, tips to avoid rookie mistakes, and recommendations for top-notch courses—because your peace of mind is priceless.

Table of Contents

- Key Takeaways

- Why Expense Tracking Monitoring Tools Matter

- How to Master These Tools (Step-by-Step Guide)

- Best Budgeting Courses That Include Expense Tracking Tools

- Tips for Optimizing Your Budget Like a Pro

- Real-Life Success Stories Using Expense Trackers

- Frequently Asked Questions About Expense Tracking

- Conclusion: Start Taking Control Today

Key Takeaways

- Expense tracking monitoring tools help you identify spending leaks before they drain your wallet.

- Budgeting courses are goldmines for mastering both personal finance basics and advanced techniques using technology.

- Finding the right tool means understanding what features align best with your lifestyle—not all apps are created equal.

- Maintenance matters: Consistency trumps perfection when monitoring expenses.

Why Expense Tracking Monitoring Tools Matter

“I used to think I was broke because my rent was too high… until I realized I spent over $500 on avocado toast last year. True story.”

Sure, it sounds dramatic, but countless people fall victim to unnoticed daily habits that add up fast. Without proper visibility into your spending patterns, it’s easy to drift off course—especially if you rely solely on guesswork. That’s why effective expense tracking monitoring tools act as your financial GPS system:

- Visibility: See exactly where every dollar goes, categorized neatly by dining, shopping, bills, etc.

- Accountability: Hold yourself accountable without judgment; data doesn’t lie!

- Actionable Insights: Spot trends early so you can adjust behaviors in real time.

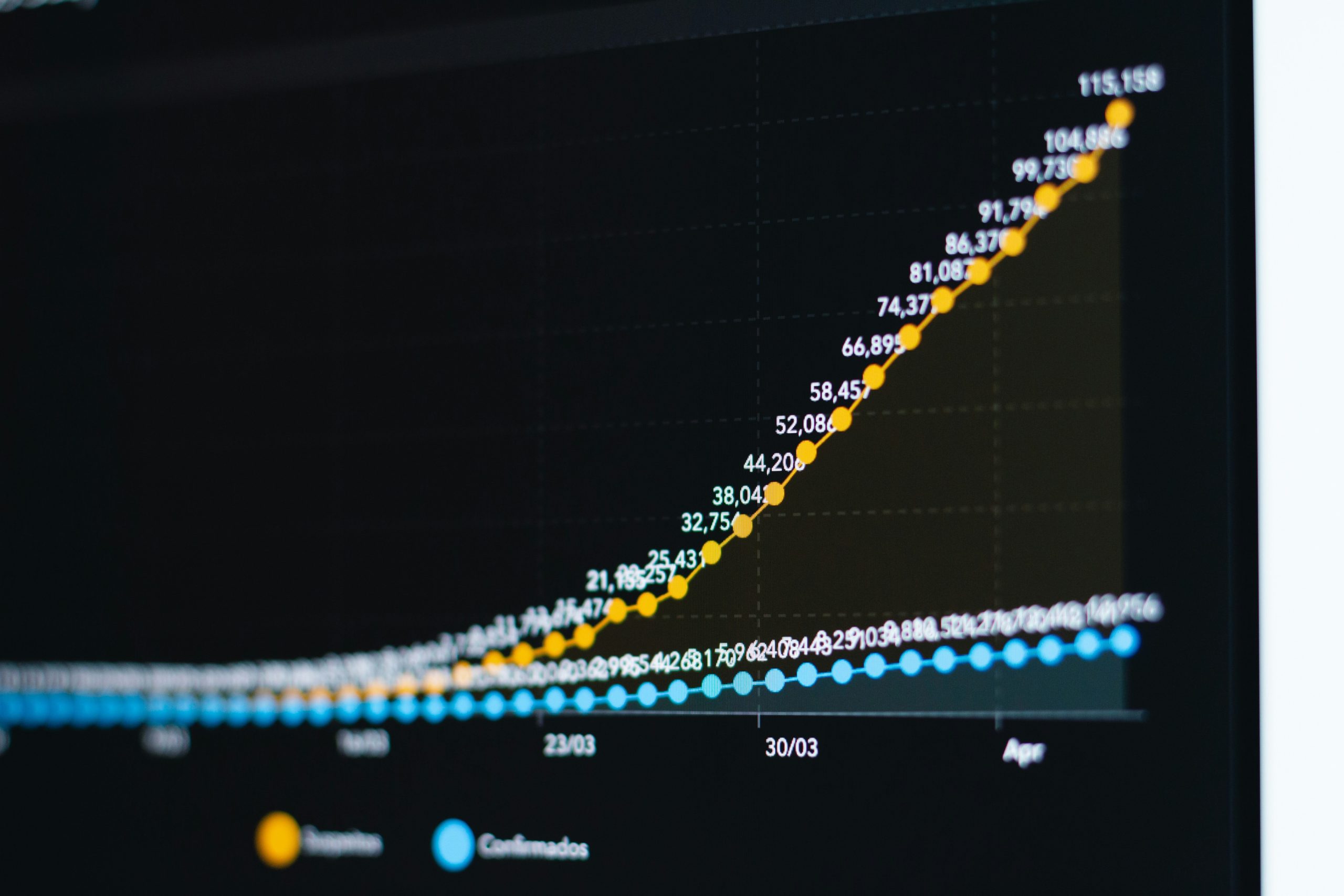

Average monthly spending breakdown based on recent surveys.

How to Master These Tools (Step-by-Step Guide)

Optimist You: “This will only take five minutes!”

Grumpy You: “Unless coffee breaks count toward those five minutes…”

-

Pick the Right Tool (It’s Not One Size Fits All)

Choose from apps like Mint, YNAB (You Need A Budget), PocketGuard, or even Google Sheets templates depending on complexity comfort level.

-

Sync Your Accounts Safely

Ensure your chosen platform integrates securely with banks or credit cards. Encryption standards should be non-negotiable here.

-

Categorize Automatically + Manually Adjust

Automation handles most tasks, but manual tweaks keep accuracy intact, especially for unique transactions like online business purchases.

-

Set Alerts & Notifications

Low balance warnings, bill due reminders, and overspending thresholds save headaches later.

-

Review Weekly, Analyze Monthly

Instead of micro-managing daily, set aside focused review sessions to reflect broadly without burning out.

![]()

Best Budgeting Courses That Include Expense Tracking Tools

Don’t try reinventing the wheel alone! Enroll in trusted budgeting courses tailored to demystify complex systems while building foundational skills:

| Course Name | Platform | Highlights |

|---|---|---|

| “Smart Budgeting Made Simple” | Udemy | In-depth walkthroughs of popular tools plus bonuses like cheat sheets. |

| “Financial Literacy Foundation” | Coursera | Focuses on overall financial health alongside practical expense strategies. |

| “YNAB Bootcamp” | YNAB Official Website | Exclusive tutorials for beginners transitioning to zero-based budgeting method mastery. |

Top budgeting courses featuring expense tracking modules designed for success.

Tips for Optimizing Your Budget Like a Pro

- Create multiple savings goals instead of one giant lump sum (“Vacation Fund” vs. “Future Savings”).

- Assign fixed amounts to discretionary items upfront—it’s harder to overspend after decisions feel made already.

- Use cash envelopes digitally via apps mimicking envelope budgets (fancy tech twist).

Pro Tip Gone Wrong:

“Ignore subscriptions entirely.” WRONG! They eat away silently like termites. Always audit reoccurring charges semiannually.

Real-Life Success Stories Using Expense Trackers

Meet Sarah*, who climbed out of $8K debt within two years thanks to diligent syncing across Mint and her custom Excel formula dashboard:

“Seeing visual progress kept me motivated longer than expected…plus guilt-tripped impulse orders worked wonders 😂.”

Sarah’s journey showcases disciplined application of expense tracking principles through structured planning.*Names altered for privacy.

Frequently Asked Questions About Expense Tracking

1. Do Free Apps Work as Well as Paid Ones?

Many free apps deliver excellent functionality—just ensure premium versions justify their price tag against core needs.

2. Can Spreadsheets Still Compete Against Modern Apps?

Absolutely! For control freaks or those wary of third-party sharing, spreadsheets remain powerful yet customizable alternatives.

3. How Often Should I Check My Tracker?

Daily isn’t necessary—weekly reviews coupled with occasional big-picture audits suffice comfortably.

Conclusion: Start Taking Control Today

Implementing effective expense tracking monitoring tools might seem intimidating initially—but investing effort upfront pays exponential dividends long-term. Plus, who wouldn’t want fewer sleepless nights fretting over finances? Whether utilizing dedicated software or learning more through expert-led courses, there’s truly no excuse left for remaining clueless about cash flow!

Remember:

“Like a Tamagotchi, your SEO also thrives under consistent care. Keep those analytics fed!”