Ever stared at your bank statement and wondered where all your money disappeared to? You’re not alone. In fact, studies show that nearly 60% of Americans don’t track their expenses regularly. If you’re nodding along (or cringing), this blog is for you.

In this guide, we’ll explore how budgeting courses can teach you the art of expense tracking success metrics—the secret sauce to financial freedom. We’ll cover:

- The pain points of poor expense tracking habits.

- A step-by-step approach to mastering expense tracking through budgeting courses.

- Tips, examples, and FAQs to turn you into an expense-tracking ninja.

Table of Contents

- Key Takeaways

- Why Expense Tracking Matters

- How Budgeting Courses Can Help You Master Expense Tracking

- Pro Tips for Crushing Expense Tracking Success Metrics

- Real-Life Examples of Budgeting Wins

- Frequently Asked Questions

- Conclusion

Key Takeaways

- Expense tracking helps you understand spending patterns so you can save smarter.

- Budgeting courses provide frameworks, tools, and accountability to improve your financial habits.

- Success metrics like savings rate and discretionary spending ratios are key indicators of progress.

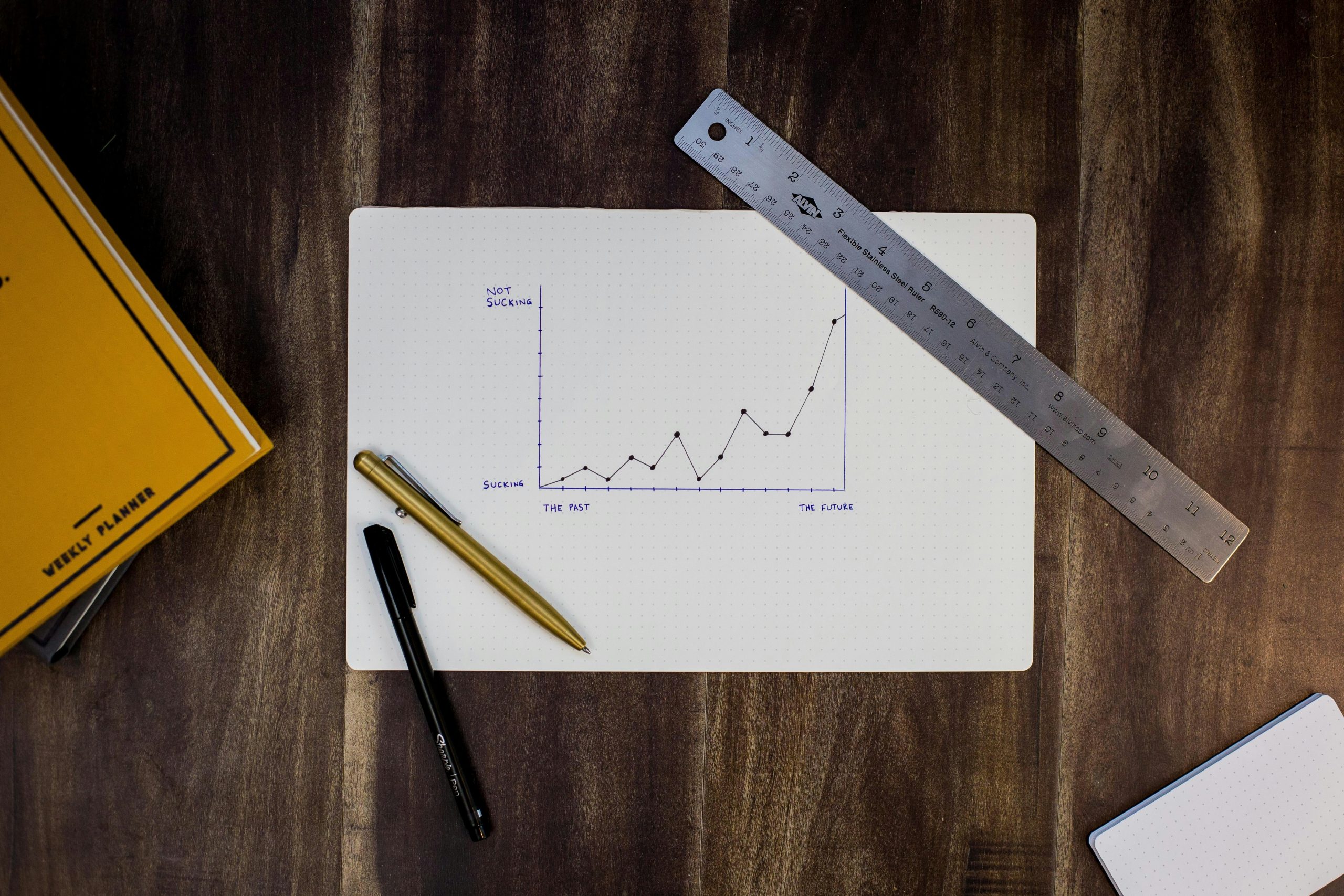

Why Expense Tracking Matters—And Why Most People Fail Miserably

I once tried tracking my own expenses using a dusty notebook from 2018. Spoiler alert: It failed harder than *Pogs* as a collectible trend in the ’90s. I’d forget receipts, lose the notebook, or just plain slack off. Sound familiar?

Here’s why failing to track expenses matters:

- No Clarity: Without knowing where your money goes, it’s impossible to build realistic budgets.

- Missed Savings Opportunities: Hidden subscriptions and impulse buys add up faster than coffee shop loyalty cards.

- Long-Term Financial Stress: Ignoring small leaks leads to massive debt avalanches later.

Alt Text: A visual representation of common issues like lost receipts, confusion over categories, and inconsistent tracking methods.

How Budgeting Courses Turn You Into an Expense-Tracking Jedi

Optimist You:* “Budgeting courses sound fancy but unnecessary.”

Grumpy You: “Ugh, fine—but only if they actually work.”*

Trust me, these courses aren’t just fluff. Here’s what makes them legit:

What You Learn in Budgeting Courses

- Categorization Systems: Ever struggled with labeling Uber Eats under “Food” vs. “Transport”? Courses break down categorization madness.

- Automated Tools: No more dusty notebooks—hello apps like Mint and YNAB!

- Success Metrics That Work: From Debt-to-Income Ratio to Net Worth Growth, you’ll learn which numbers matter most.

Step-by-Step Approach Taught in Top Courses

- Gather Data: Sync your accounts, import transactions, and review every dollar spent.

- Create Categories: Group similar expenses together (e.g., Groceries, Utilities).

- Analyze Trends: Look for patterns—like consistently overspending on entertainment.

- Set Goals: Use insights to create actionable targets (e.g., reduce dining out by $100/month).

- Monitor Progress: Track monthly changes against your goals.

Alt Text: A flowchart explaining the five-step process learned in budgeting courses.

Pro Tips for Crushing Expense Tracking Success Metrics

Before we dive in, here’s one piece of brutally honest advice:

“Don’t download another app until you’ve used the one you already have.”

Seriously, hoarding apps won’t fix bad habits. Now let’s look at some better tips:

- Use Visual Reports: Apps like Personal Capital offer slick charts to visualize your spending trends.

- Fake the Bank: Pay yourself first by automating transfers to savings before bills hit.

- Challenge Yourself Monthly: Try no-spend weeks or limit categories like dining out to stretch those dollars further.

- Reward Milestones: Celebrate hitting goals—but keep treats cheap (like Netflix instead of Coachella tickets).

Real-Life Examples of Budgeting Wins

Jane D., a former fast-fashion addict, enrolled in a popular online course called *Money Mastery Bootcamp*. Within three months, she:

- Reduced discretionary spending by 40%.

- Built an emergency fund worth $5,000.

- Increased her retirement contributions by 15%.

“Learning to calculate my savings rate changed everything,” Jane says. “I saw real progress each month, which kept me motivated.”

Alt Text: A bar graph comparing Jane’s starting and ending balances before and after taking a budgeting course.

Frequently Asked Questions

Do I Need Fancy Software to Track Expenses?

Not at all! Many free apps like Mint and PocketGuard do wonders. However, premium tools often include advanced features like investment trackers.

Can I Really Stick to a Course Long Enough to See Results?

Yes—if you commit. Pro tip: Pair learning modules with daily accountability reminders to stay on track.

Are These Metrics Universal?

While core principles apply broadly, customizing them to fit your unique situation ensures long-term success.

Conclusion

Mastering Expense Tracking Success Metrics isn’t rocket science—it’s practical, structured, and completely achievable with the right guidance. Whether you’re drowning in debt or simply curious about tightening your belt, budgeting courses can be life-changing investments.

Ready to crush your financial goals? Enroll in a course today and start building habits that stick. And remember:

Coffee costs less

When you know your limits

Cheers to saving!