Ever found yourself staring at your bank account, wondering where all your money went? You’re not alone. Studies show that 60% of people struggle with tracking their expenses effectively, leading to overspending and financial stress. But what if there was a way to take control—without losing your sanity?

In this guide, we’ll dive deep into the world of Expense Tracking Monitoring Tools and how they can revolutionize your budgeting skills, especially when paired with education from top-notch budgeting courses. By the end, you’ll learn:

- Why Expense Tracking Monitoring Tools are essential for personal finance success.

- A step-by-step breakdown of using these tools efficiently.

- The best practices (and worst mistakes) in expense tracking.

Table of Contents

- Key Takeaways

- Why Expense Tracking Matters

- How to Use Expense Tracking Monitoring Tools Effectively

- Tips and Best Practices

- Real-World Examples

- Frequently Asked Questions

Key Takeaways

- Expense Tracking Monitoring Tools help eliminate guesswork in managing finances.

- Budgeting courses teach strategies to maximize the use of these tools.

- Avoid common pitfalls like underestimating small purchases—it adds up!

Why Expense Tracking Monitoring Tools Matter

I once tried to track my expenses manually on a spreadsheet. It worked… until I forgot an entire month of coffee runs because who remembers every $3 latte? Spoiler alert: My wallet did not thank me.

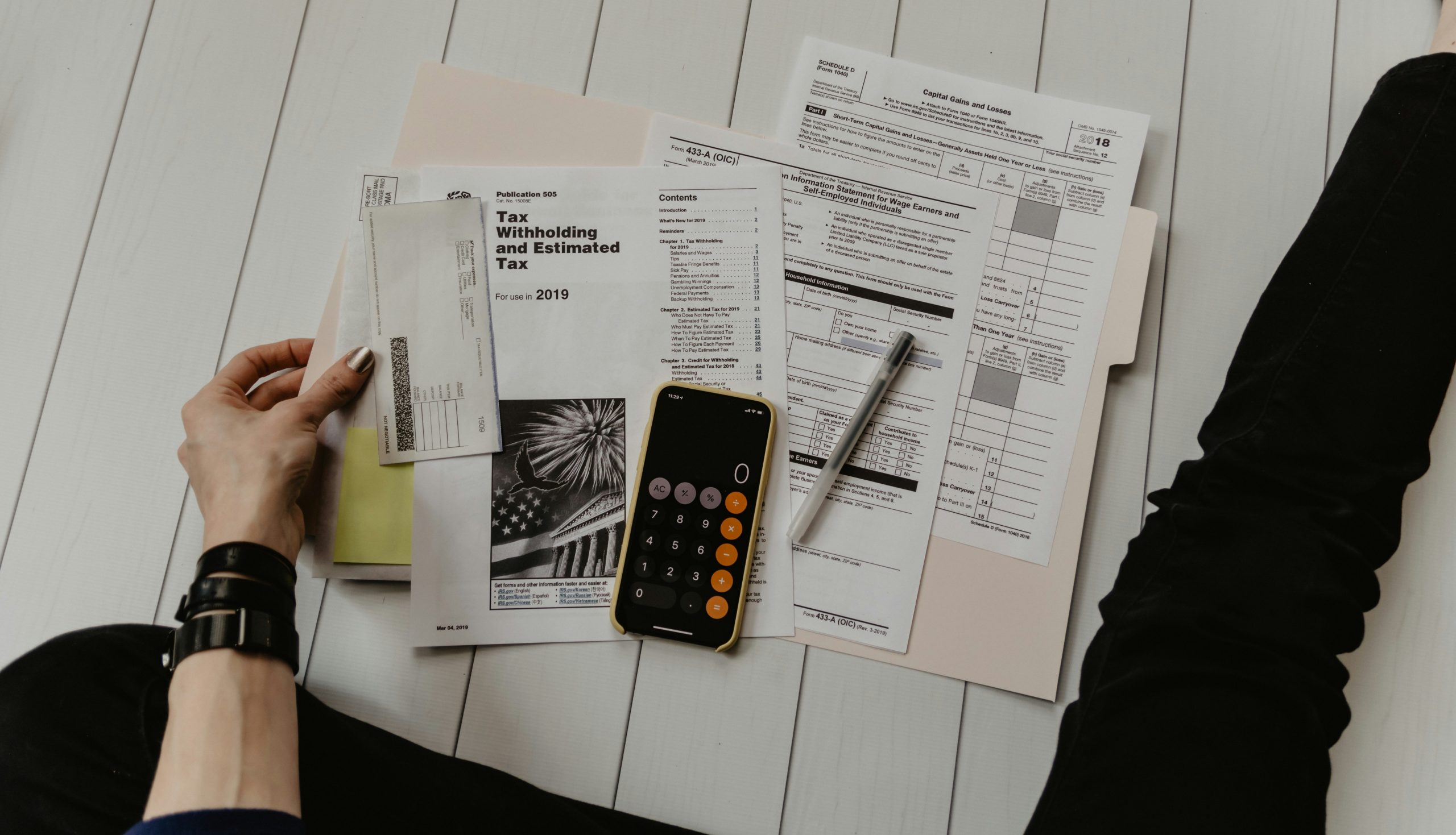

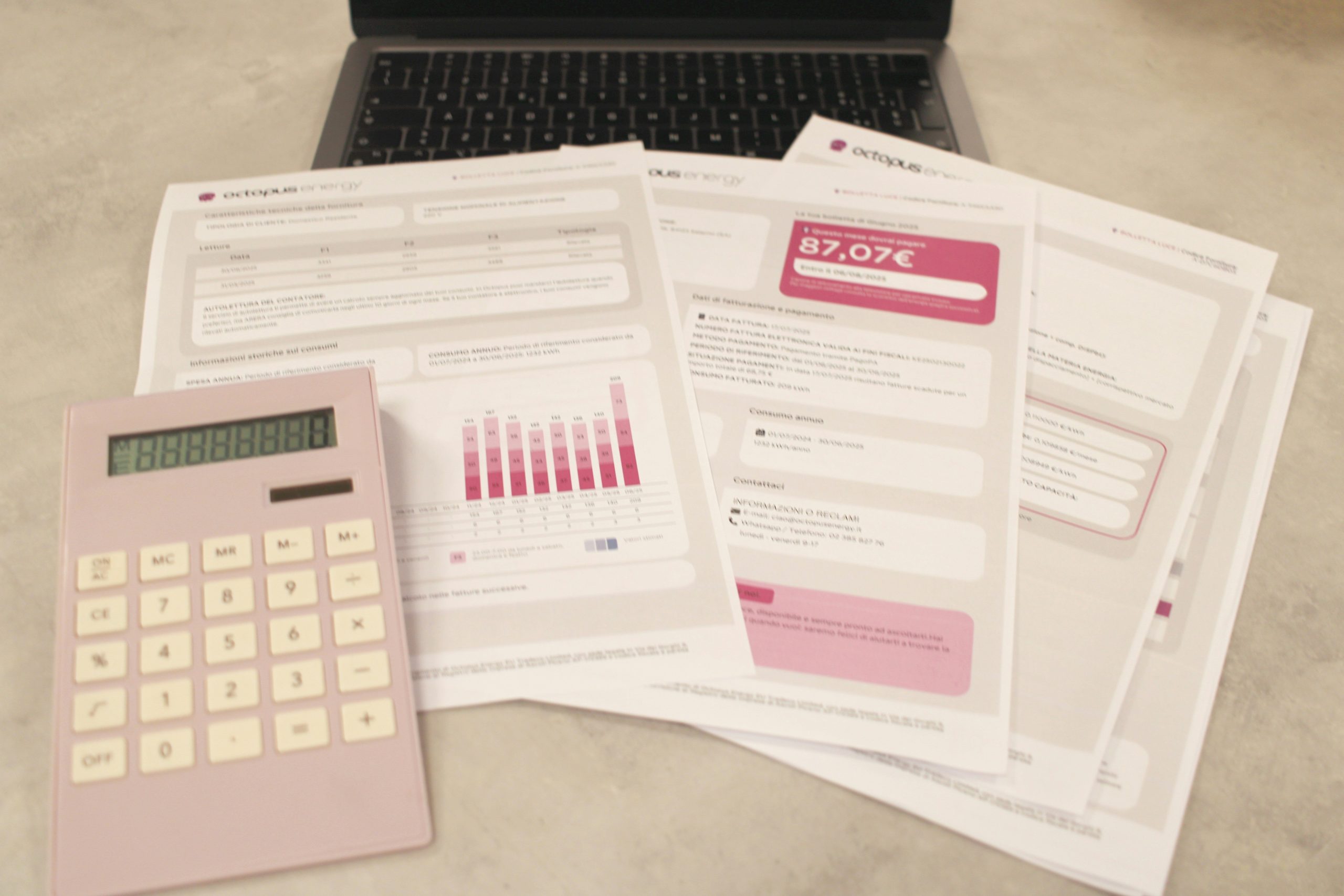

Expense Tracking Monitoring Tools solve this problem by automating data collection and categorization. These tools sync with your bank accounts, credit cards, and even cash transactions to give you real-time insights into your spending habits. They’re particularly useful for students taking budgeting courses, as they reinforce classroom lessons through hands-on application.

The importance of mastering these tools cannot be overstated. According to recent studies, users who leverage Expense Tracking Monitoring Tools tend to save 20% more annually. That’s enough to fund a vacation—or pay off some debt.

How to Use Expense Tracking Monitoring Tools Effectively

“Optimist You:” *‘This will be easy!’*

“Grumpy You:” *‘Ugh, fine—but only if coffee’s involved.’*

- Choose Your Tool Wisely: Popular options include Mint, YNAB (You Need A Budget), and PocketGuard. Each has pros and cons depending on your needs.

- Connect Financial Accounts: Once you’ve picked a tool, link it to your bank accounts, credit cards, loans, etc. No need to panic; most tools use secure encryption protocols.

- Categorize Spending: Let the tool automatically categorize transactions or tweak them manually. This is crucial for understanding patterns—you might discover your “groceries” category includes too many late-night pizza orders.

- Set Budget Goals: Based on insights from previous steps, create realistic budgets. For instance, limit dining out to $150/month or allocate funds toward paying off debt faster.

- Review Regularly: Don’t set it and forget it! Schedule weekly check-ins to review progress. Sounds boring, but think of it as self-care for your wallet.

Tips and Best Practices

Here are five killer tips (and one terrible tip!) to level up your expense tracking game:

- Use split transactions wisely—for example, separate business and personal expenses within shared receipts.

- Automate savings transfers so you’re always putting money aside before spending.

- Leverage alerts for unusual activity. If someone buys a $500 TV on your card without permission, you’ll know ASAP.

- Prioritize integration-friendly apps. Want your budget planner to talk to your calendar? Make sure compatibility exists.

- Ditch spreadsheets unless absolutely necessary. Automation = Less hassle.

- (Terrible Tip): Ignore subscription services entirely. Thinking about canceling Netflix? Maybe don’t do that unless your budget screams otherwise.

Real-World Examples

Meet Sarah, a freelance graphic designer who enrolled in a budgeting course last year. Initially skeptical about Expense Tracking Monitoring Tools, she decided to give Mint a shot after seeing classmates rave about it. Within six months, she:

- Reduced her monthly spending by 15%.

- Paid off $2,000 in credit card debt.

- Increased her emergency fund balance fourfold.

Frequently Asked Questions

Q: Are Expense Tracking Monitoring Tools safe?

Absolutely! Most reputable tools use bank-level encryption to protect your data. Just ensure you’re downloading verified apps from trusted sources.

Q: Do I really need a budgeting course if I already understand basic finance?

Budgeting courses provide structure and accountability. Plus, learning advanced techniques can supercharge your savings journey.

Q: Can’t I just use Excel instead?

Technically yes, but why bother when tools automate tedious tasks? Save yourself hours each week.

Conclusion

Expense Tracking Monitoring Tools aren’t just fancy gadgets—they’re lifelines for anyone looking to gain control over their finances. Paired with education from budgeting courses, they offer unparalleled clarity and empowerment. Remember:

- Track diligently but review consistently.

- Learn from mistakes—and celebrate wins!

Like a Tamagotchi, your budget requires daily care. Stick with it, and watch your financial health flourish!

—

Haiku incoming:

Cash flows like rivers, Budgets keep dreams afloat—row! Tools are life vests now.