Ever stared at your bank statement in December and wondered, “Where did all my money go?” You’re not alone. Most people have no idea how much they spend annually because tracking feels overwhelming—or boring. But what if it didn’t?

This post dives into why annual expense tracking is a game-changer for personal finance enthusiasts (and even those who hate spreadsheets). By the end, you’ll know how budgeting courses can help simplify this process—and why investing time now will save you thousands later. Let’s break down the problem, solutions, tools, examples, and frequently asked questions—all peppered with some brutally honest advice.

Table of Contents

- Why Annual Expense Tracking Matters

- How to Track Your Expenses Step by Step

- Tips for Mastering Budgeting Courses

- Real-Life Success Stories

- FAQs About Annual Expense Tracking

Key Takeaways

- Annual expense tracking helps identify spending patterns, reduce waste, and achieve financial goals faster.

- Budgeting courses teach practical skills like automating expenses, categorizing costs, and creating actionable plans.

- Tools like Mint, YNAB, and Excel make annual expense tracking less painful—and sometimes fun(!).

- Avoid common mistakes like ignoring small recurring charges; these add up big-time over a year.

- Stay consistent—even imperfect tracking beats doing nothing.

Why Does Annual Expense Tracking Matter?

Let me tell you about the time I accidentally subscribed to *three* different streaming services simultaneously. In isolation, each seemed harmless—but together, they cost me nearly $400 that year. That’s rent money squandered on sitcom reruns!

Here’s why annual expense tracking matters:

- Hidden Costs Add Up: Coffee runs, app subscriptions, impulse purchases—small leaks sink ships.

- Tax Season Stress: Without organized records, preparing taxes becomes a nightmare.

- Saving Goals: How do you plan for vacations or emergencies without knowing where your cash goes?

Optimist You: “Tracking my annual expenses sounds empowering!”

Grumpy Me: “Ugh, but only if snacks are involved.”

How to Track Your Expenses Step by Step

-

Gather All Financial Data

-

Categorize Spending

-

Analyze Yearly Totals

-

Create Actionable Insights

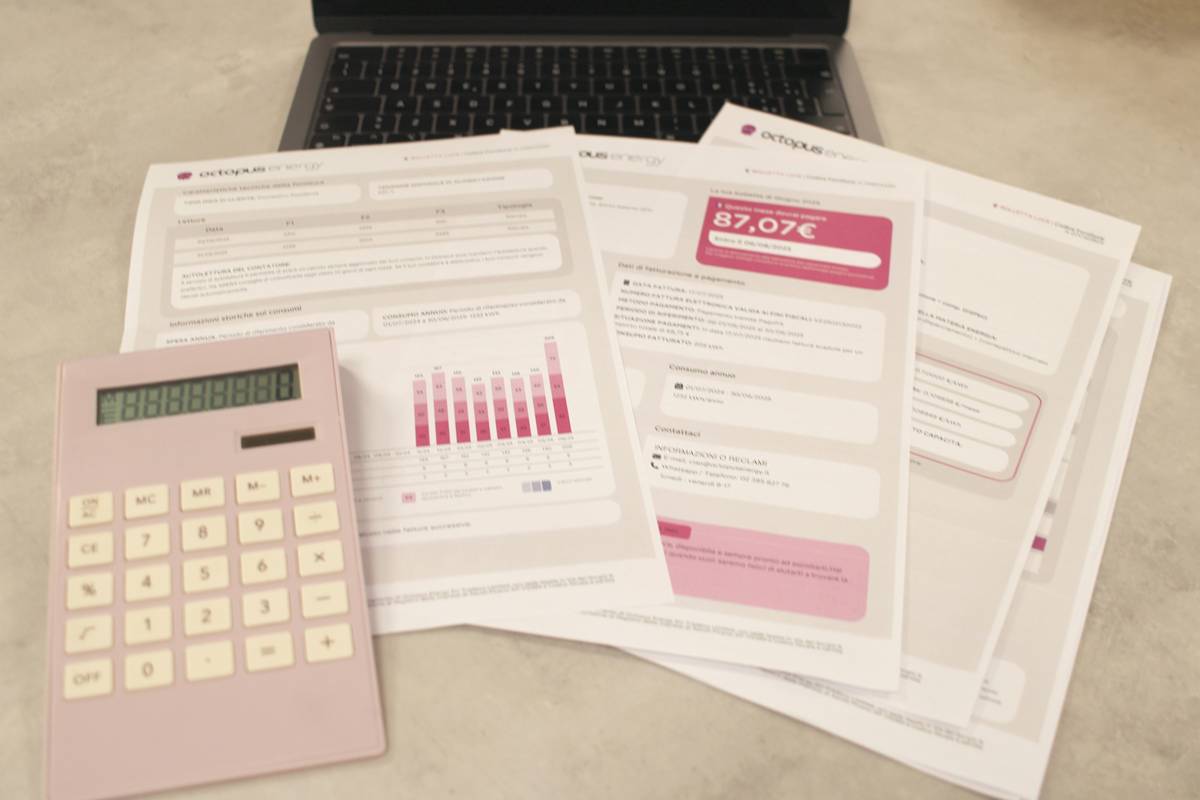

Start simple: collect bank statements, credit card bills, receipts, and subscription emails. This might sound tedious, but trust me, having everything in one place sets you free later.

Create buckets like housing, food, entertainment, and savings. Many apps (like Mint) automate this step, so don’t panic!

Look for trends—are you overspending on dining out? Are subscriptions quietly draining your account? Patterns emerge when viewed annually.

Set limits, cancel unnecessary subscriptions, and redirect wasted funds toward goals (hello, dream vacation).

Tips for Mastering Budgeting Courses

If managing your money feels intimidating, budgeting courses are lifesavers. Here’s how to get the most from them:

- Pick Beginner-Friendly Options: Look for terms like “starter,” “foundation,” or “easy.”

- Leverage Free Trials: Test before committing—you wouldn’t buy jeans online without trying them first, right?

- Commit to Weekly Reviews: Set aside 30 minutes weekly to apply lessons learned.

Rant Alert: Stop Falling for ‘Get Rich Quick’ Schemes

I once signed up for an “exclusive” coaching program promising six-figure profits within months. Spoiler alert: It was garbage. Real wealth-building takes patience, consistency, and effort—not shortcuts.

Real-Life Success Stories

Meet Sarah, a teacher who struggled with mounting debt after medical bills. She enrolled in a popular budgeting course and transformed her finances:

“I went from dreading every bill notification to confidently tackling my debt head-on. Plus, I started saving enough for a trip to Europe!” – Sarah T.

FAQs About Annual Expense Tracking

- Do I really need a course for expense tracking?

- Nope! DIY methods work too, but courses streamline learning and often include templates or tools.

- What software should I use?

- Mint and YNAB are great starters. If geeky spreadsheets excite you, Excel works wonders too.

- How long does it take to see results?

- Within a month, you’ll spot areas to cut back. Major shifts happen around month three to six.

Conclusion

Remember, friends, mastering annual expense tracking isn’t rocket science—it’s just dedication wrapped in good habits. Whether through budgeting courses or old-school pen-and-paper methods, start today. Because life changes when you control your money instead of letting it control you.

Final grumble? Fine. Start tomorrow—if there’s coffee nearby.

Like dial-up internet speeds, good habits form slowly but stick forever. 🌱