Ever stared at your bank statement on a Sunday night, wondering where all your money disappeared? If you’re nodding yes, you’re not alone. Studies show that nearly 60% of adults struggle to stick to a budget. But here’s the kicker—most don’t even know how much they spend weekly. Enter weekly expense tracking, your secret weapon for financial freedom. In this guide, we’ll walk you through why it matters and how budgeting courses can transform your money game.

Table of Contents

- Why Weekly Expense Tracking Matters

- How to Start Tracking Weekly Expenses (Yes, Without Losing Your Mind)

- 7 Tips to Master Weekly Expense Tracking Like a Pro

- Success Stories: Real People Who Nailed It

- FAQs About Weekly Expense Tracking

What You’ll Learn

- The role of weekly expense tracking in building lasting financial habits.

- A step-by-step process to track your expenses efficiently.

- Proven tips and tools recommended by top personal finance experts.

- Inspirational stories from people who’ve crushed their budgets.

Why Weekly Expense Tracking Matters (And Why It’s Not Boring)

Let me confess something: I once went a whole month without checking my spending. Spoiler alert—it wasn’t pretty. That $5 coffee habit turned into a $150 monthly black hole. Ouch.

Here’s the raw truth: ignoring weekly expense tracking is like driving blindfolded. You might coast for a while, but eventually, you’ll crash. And trust me, crashing financially feels worse than hitting a pothole during rush hour.

Budgeting courses often highlight weekly expense tracking as the cornerstone of financial health. These courses teach you to recognize spending patterns, identify leaks, and allocate funds better—skills everyone needs whether you’re living paycheck-to-paycheck or saving for a dream vacation.

How to Start Tracking Weekly Expenses (Yes, Without Losing Your Mind)

*Optimist You*: “This is going to be so easy!”

*Grumpy You*: “Yeah, right… unless there’s pizza involved.”

Fair enough. Let’s break it down:

Step 1: Choose Your Tools

Pick an app or good old pen-and-paper. Apps like Mint or YNAB (You Need A Budget) make life easier, but if analog vibes speak to your soul, grab a notebook.

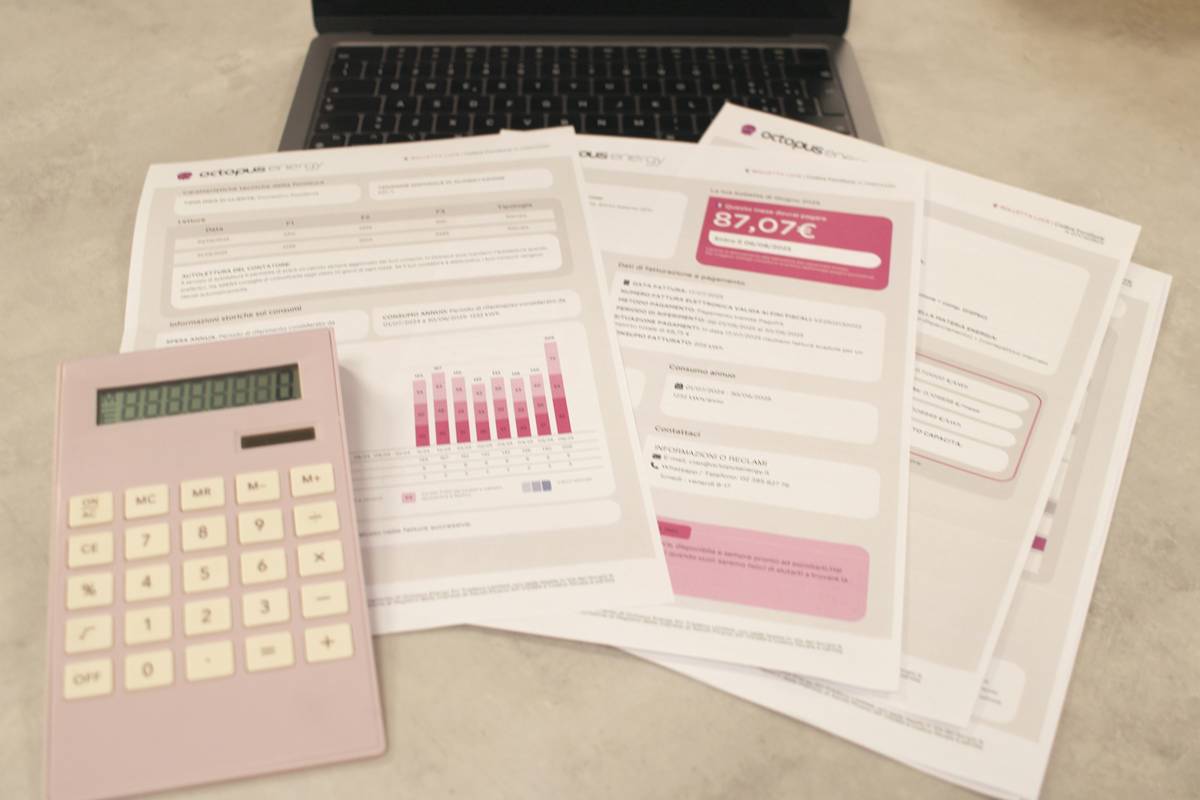

Step 2: Categorize Your Spending

Create categories like groceries, entertainment, rent, etc. This helps spot trends faster—like realizing how much you really spend on late-night snacks.

Step 3: Set Aside Time Each Week

Schedule 15 minutes every Sunday (or any other day). Consistency is key to making this stick.

Step 4: Review & Adjust

Analyze what worked and what didn’t. Flexibility ensures you won’t give up after one bad week.

7 Tips to Master Weekly Expense Tracking Like a Pro

- Automate Everything: Use apps that sync directly with your accounts for seamless updates.

- Be Honest: No hiding those impulse buys—they’re part of the learning process.

- Use Visuals: Charts and graphs help you “see” where your money goes.

- Set Micro-Goals: Saving $20 a week adds up quicker than you think.

- Avoid Over-Categorizing: Too many labels get overwhelming.

- Reward Yourself: Celebrate small wins to stay motivated.

- Terrific Tip Disclaimer: “Wait until Friday to update your tracker.” *Hint: Don’t do this.*

Success Stories: Real People Who Nailed It

Meet Sarah, a teacher who took a budgeting course last year. She started tracking her weekly expenses and cut unnecessary subscriptions, freeing up $80/month. Fast-forward six months, she’d saved enough to book her dream trip to Japan.

Or Jake, a freelancer who struggled with irregular income. He enrolled in a course teaching him to categorize his business vs. personal spending each week. Now he manages his cash flow like a boss—and avoids overdraft fees!

FAQs About Weekly Expense Tracking

Q: How long does it take to see results?

A: Most people notice changes within 2-3 weeks once they start consistently tracking.

Q: Do I have to use fancy apps?

A: Nope! Pen-and-paper works just fine if tech isn’t your thing.

Q: What if I forget to log expenses?

A: Set reminders on your phone or automate with apps designed for forgetful folks (we’ve all been there).

Conclusion

Weekly expense tracking isn’t glamorous, but it’s powerful. Combined with insights from budgeting courses, it can revolutionize how you manage money. Remember, small actions lead to big changes over time. So grab a cup of coffee—or maybe skip it this week—and start tracking today.

Like dial-up internet, patience pays off when mastering your finances. Happy budgeting!

Sidebar meme reference: “One does not simply ignore their weekly expenses.” 🧙♂️