Ever felt paralyzed by the thought of your monthly bills, credit card statements, and loan payments? You’re not alone. According to a recent study, nearly 60% of Americans live paycheck to paycheck, with many struggling to manage their debts effectively. But here’s the kicker: most people don’t even know where to start when it comes to tackling these financial woes.

In this guide, we’ll cover everything you need to know about Debt Management Risk Assessments, why they matter, and how specialized budgeting courses can empower you to regain control of your finances—without drowning in spreadsheets or falling for financial “quick fixes.”

You’ll learn:

- Why Debt Management Risk Assessments are critical for long-term stability.

- Step-by-step actions to choose the right budgeting course for you.

- Tips from experts on making the most out of personal finance education.

- Real-life success stories proving transformation is possible.

Table of Contents

- Key Takeaways

- What Are Debt Management Risk Assessments?

- Choosing the Right Budgeting Course

- Tips to Maximize Results from Personal Finance Education

- Success Stories: Real People Who Transformed Their Finances

- Frequently Asked Questions About Budgeting Courses

Key Takeaways

- Debt Management Risk Assessments identify vulnerabilities in your financial health.

- Budgeting courses provide tools and strategies tailored to individual needs.

- Education-focused debt solutions create lasting habits, unlike quick fixes.

- You can achieve financial freedom by taking consistent action backed by knowledge.

What Are Debt Management Risk Assessments? And Why Should You Care?

Let me paint a picture. A few years ago, I was knee-deep in credit card debt after ignoring red flags like mounting interest rates and late fees. Then came the moment of clarity—or panic—as I realized my minimum payments weren’t even denting the principal amount. That’s when I stumbled upon something called Debt Management Risk Assessments.

A Debt Management Risk Assessment is essentially a deep dive into your financial situation to pinpoint areas of risk. Think of it as an MRI scan for your wallet—it shows what’s working, what’s broken, and what could potentially cause chaos if left unchecked.

This process helps you:

- Evaluate your current cash flow.

- Identify risky spending patterns.

- Prioritize high-interest debts.

- Plan for unexpected emergencies.

Grumpy Optimist Dialogue Time:

Optimist You: “Great, now I have a roadmap to fix my finances!”

Grumpy You: “Yeah, but remember that one time you downloaded that app and never opened it again? Let’s actually follow through.”

Choosing the Right Budgeting Course for Debt Management Risk Assessments

Once you’ve conducted a thorough assessment, the next step is finding a budgeting course that fits your unique needs. Here’s how:

How Do You Pick Between Online vs. Offline Courses?

Both options have pros and cons. Online courses offer flexibility; offline ones provide accountability. If you thrive in solitary environments (hello, morning coffee + laptop), online might be best. But if sitting at home leads to distractions (*cough* Netflix *cough*), consider a classroom setting.

Do They Actually Teach Skills Relevant to Debt Management?

Be wary of generic programs promising “financial freedom” without specifics. Look for instructors who emphasize practical skills like expense tracking, debt snowball methods, and automated savings systems.

Pro Tip: Check reviews and testimonials before signing up. And no, reading two random Amazon reviews doesn’t count—you want detailed feedback from former students.

5 Expert Tips to Get the Most Out of Budgeting Courses

- Start Small and Scale Gradually: Don’t try to overhaul every aspect of your life overnight. Focus on mastering one skill first, like creating a weekly budget.

- Automate Savings: Use apps like Digit or Ally Bank to stash away small amounts automatically. Your future self will thank you.

- Track Progress Regularly: Update your progress daily or weekly. Sounds basic, right? Yet so many skip this step!

- Join Accountability Groups: Facebook groups or Reddit communities centered around personal finance can keep you motivated.

- Avoid This Terrible Tip: Following overly complicated budget hacks designed for millionaires. Keep it simple!

Real Success Stories: How Others Used Budgeting Courses to Master Debt Management Risk Assessments

Meet Sarah, a 28-year-old teacher who wiped out $42,000 in student loans using a combination of online budgeting courses and diligent monthly assessments. She credits her success to visualizing her goals—a trip to Greece—and staying committed despite setbacks.

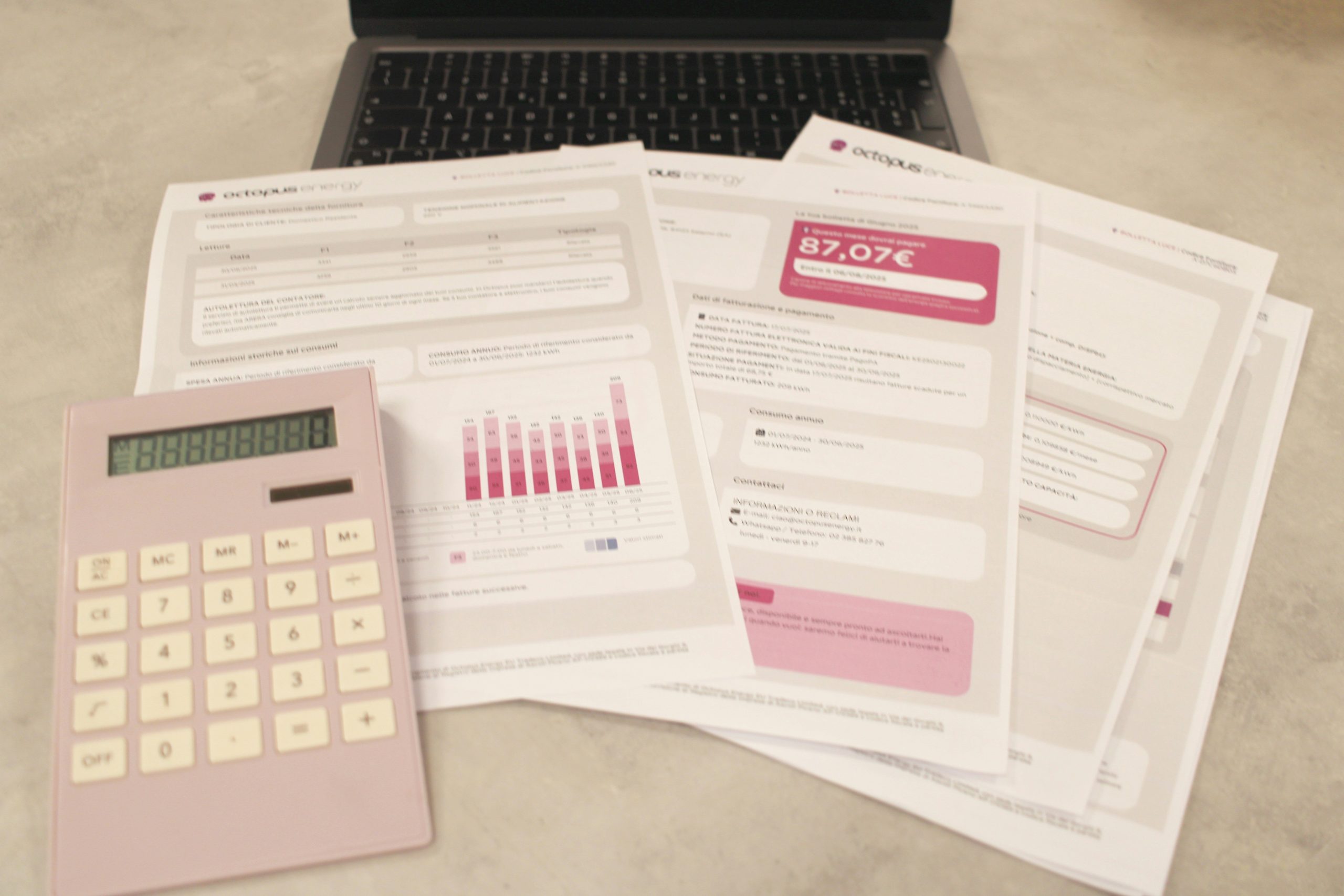

Visual representation helps too. Below is a chart showing Sarah’s journey over three years.

Sarah says, “It wasn’t easy, but knowing I had a structured plan made all the difference.”

FAQs About Budgeting Courses and Debt Management Risk Assessments

Can Anyone Learn to Manage Debt Effectively?

Absolutely. With the right guidance and persistence, anyone can develop smart money habits. The key is consistency.

How Much Do These Courses Cost?

Prices vary widely. Some free resources exist (hello, Coursera!), while premium programs may cost hundreds. Choose based on your goals and budget.

Is It Worth My Time?

If done correctly, yes. Many graduates report improved credit scores within months.

Conclusion

To sum it up, mastering Debt Management Risk Assessments requires awareness, strategy, and education. Budgeting courses provide invaluable tools to simplify complex processes. Remember:

- Understand your risks before jumping into solutions.

- Select a budgeting program aligned with your lifestyle.

- Stay consistent, patient, and proactive.

And hey, if nothing else, remember this:

Coffee fuels dreams, Budgets slay pesky debts, Freedom tastes sweet.