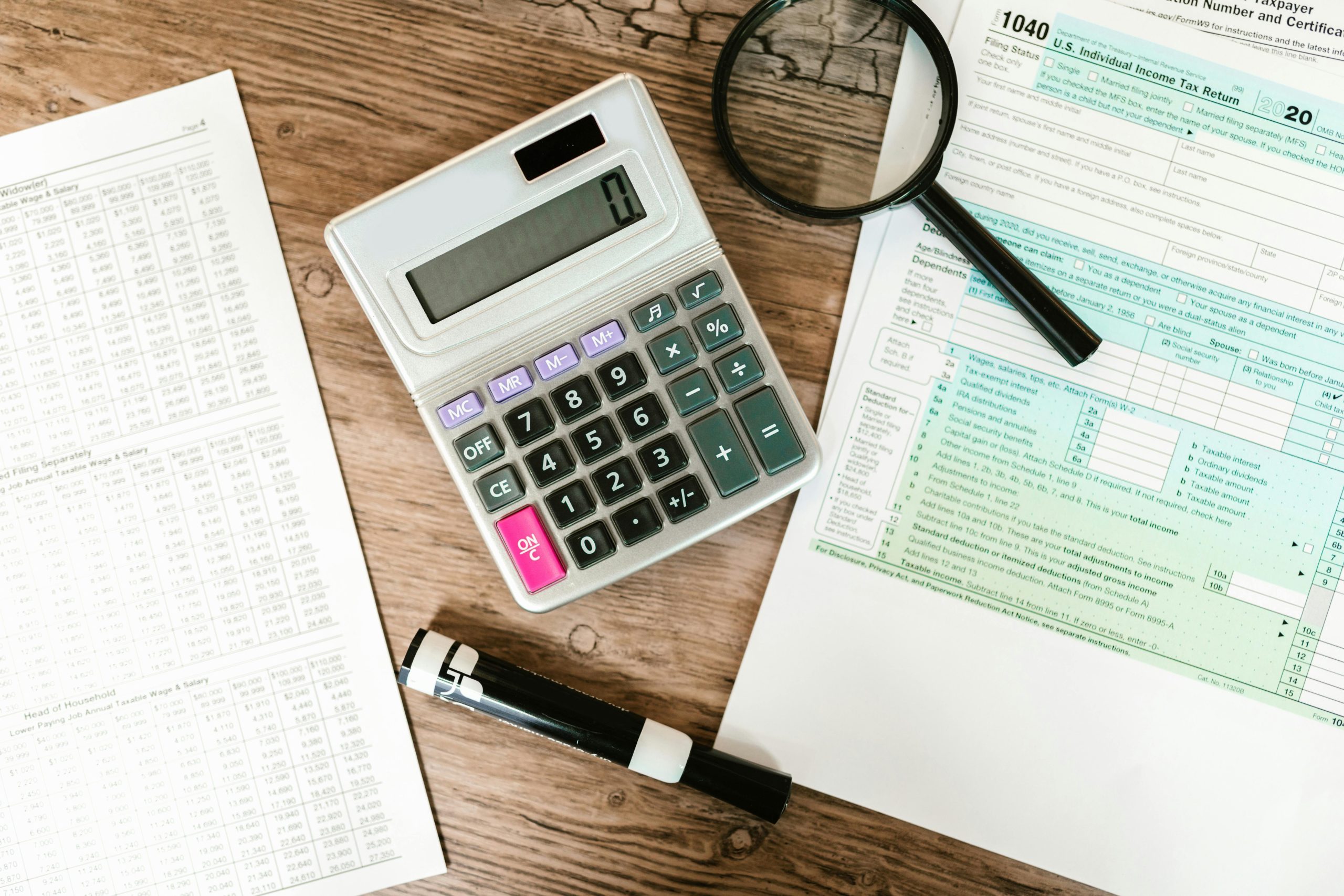

Ever stared at your credit card statement, wondering how you spent $500 on “random stuff”? You’re not alone. Americans carry an average of $6,270 in credit card debt, and that stress can feel suffocating. But here’s the good news—budgeting courses could be your secret weapon to mastering Credit Card Debt Strategies.

In this post, we’ll cover why credit card debt happens, how budgeting courses can rewire your financial habits, actionable steps to get started, real-world success stories, and some brutally honest advice on what *not* to do. Ready? Let’s dive in.

Table of Contents

- Why Credit Card Debt Happens (And Why You’re Not Alone)

- The Power of Budgeting Courses for Credit Card Debt

- Your Step-by-Step Guide to Mastering Budgeting

- 7 Expert Tips for Crushing Credit Card Debt

- Real-Life Success Stories: From Debt to Financial Freedom

- Frequently Asked Questions About Budgeting Courses

Key Takeaways

- Understanding why credit card debt spirals is step one toward solving it.

- Budgeting courses teach practical tools you can implement immediately.

- Success isn’t just about cutting back—it’s about smart spending strategies.

- You don’t need expensive programs; free resources often work wonders.

- Honesty alert: Avoid “get rich quick” schemes—they’re scams dressed as solutions.

Why Credit Card Debt Happens (And Why You’re Not Alone)

Let me tell you a story. Picture me sitting at my kitchen table, surrounded by coffee cups and receipts from Amazon purchases I barely remembered making. I had racked up over $3,000 in credit card debt because I thought, “What’s another $20?” Spoiler: Those $20s added up fast.

The truth is, most people fall into credit card debt due to poor tracking, impulsive buying, or unforeseen emergencies. Studies show that 46% of Americans are living paycheck to paycheck, leaving little room for error when unexpected expenses hit. And let’s face it—credit cards make overspending far too easy.

Optimist You: “I’ll pay off my balance next month!”

Grumpy You: “Yeah right, Suze Orman said otherwise.”

The Power of Budgeting Courses for Credit Card Debt

So how do budgeting courses come into play? They don’t just teach you fancy Excel tricks—they provide concrete frameworks to rethink your approach entirely. Think of them as therapy for your wallet.

- They build awareness: Tracking where every dollar goes helps identify leaks.

- They simplify decisions: No more guessing if you can afford that latte.

- They offer community: Many courses include forums where others share their struggles (and wins).

One standout example is Dave Ramsey’s Financial Peace University, which combines structured lessons with accountability groups. Users report paying off thousands within months using his zero-based budget method.

Your Step-by-Step Guide to Mastering Budgeting

Step 1: Assess Your Current Spending Habits

Start by gathering all bank statements, apps, and subscription services for the past three months. Use tools like Mint or YNAB (You Need A Budget) to categorize spending. If spreadsheets are your thing, download templates from sites like Vertex42.

Step 2: Prioritize Paying Off High-Interest Debts

The avalanche method tackles debts with the highest interest rates first, while the snowball method focuses on smaller balances. Both have pros and cons, but consistency matters most.

Step 3: Enroll in a Beginner-Friendly Course

Options range from free YouTube tutorials to paid platforms like Udemy or Coursera. Look for courses specifically focused on personal finance and budgeting rather than vague advice about saving generically.

7 Expert Tips for Crushing Credit Card Debt

- Set an automatic payment to avoid late fees.

- Use cash whenever possible to curb impulse buys.

- Limit yourself to one credit card—and freeze it if necessary!

- Track daily spending via apps like PocketGuard.

- Avoid lifestyle creep—don’t upgrade your life until debts vanish.

- Create sinking funds for annual bills (e.g., insurance, holidays).

- Ignore “too-good-to-be-true” offers—they usually are.

Real-Life Success Stories: From Debt to Financial Freedom

Take Sarah, who joined a local community college’s evening budgeting workshop desperate for change. She switched to biweekly payments instead of monthly ones and crushed her $10k debt in two years flat. Then there’s John, whose company offered a corporate membership to a budgeting platform—he leveraged it to negotiate lower APRs and saved hundreds monthly.

Frequently Asked Questions About Budgeting Courses

Do I Need a Degree in Finance to Benefit?

Nope! Most courses cater to beginners, breaking concepts down easily.

Are Free Resources As Effective?

Absolutely. Tools like Khan Academy offer solid foundations without charging a dime.

Will This Work if My Income Is Irregular?

Yes! Programs adapt based on income variability—just focus on percentages, not fixed numbers.

Conclusion

Becoming debt-free might sound daunting, but armed with the right strategies and proper education through budgeting courses, anyone can conquer their Credit Card Debt Blues. Remember, progress beats perfection. So grab that laptop—or pen and paper—and start planning.

P.S. Stay caffeinated during budget reviews; those numbers won’t crunch themselves.

Haiku time:

Numbers on paper, Dreams take shape under control, Freedom tastes sweeter.