Ever stared at your bank account and thought, “How did I get here?” You’re not alone. In fact, the average American carries over $90,000 in debt, according to recent studies. It’s like walking around with a financial anchor tied to your ankles. But what if there was a way to cut that rope? That’s where budgeting to eliminate debt comes into play. This post will guide you through understanding why budgeting is critical for debt elimination, step-by-step strategies to implement it, and real-world examples of people who’ve done it successfully. Get ready to take control of your money!

Table of Contents

- Why Budgeting Matters More Than You Think

- Step-by-Step Guide to Budgeting for Debt Elimination

- Best Practices to Avoid Common Pitfalls

- Real-Life Success Stories

- FAQs About Budgeting to Eliminate Debt

Key Takeaways:

- Budgeting is the foundation of any successful debt elimination plan.

- Taking an inventory of expenses helps identify wasteful spending habits.

- Enrolling in budgeting courses can provide tailored advice and accountability.

- Small sacrifices today lead to massive freedom tomorrow.

Why Budgeting Matters More Than You Think

Let me start by confessing something embarrassing—I once had $300 worth of unused streaming subscriptions because “it seemed cheap.” Sounds ridiculous, right? But this is exactly how small leaks sink big ships when it comes to personal finance. Without a solid budget, every impulse buy adds up until you’re drowning in debt.

The truth is, most people don’t track their spending because they either think it’s unnecessary or too complicated. Newsflash: ignoring the problem won’t make it go away. In fact, a study found that nearly 78% of adults live paycheck-to-paycheck. A budget forces you to confront reality, prioritize essentials, and allocate resources strategically toward eliminating debt.

Step-by-Step Guide to Budgeting for Debt Elimination

What Are the First Steps?

Optimist You: *“This sounds manageable!”*

Grumpy You: *“Ugh, fine—but only if coffee’s involved.”*

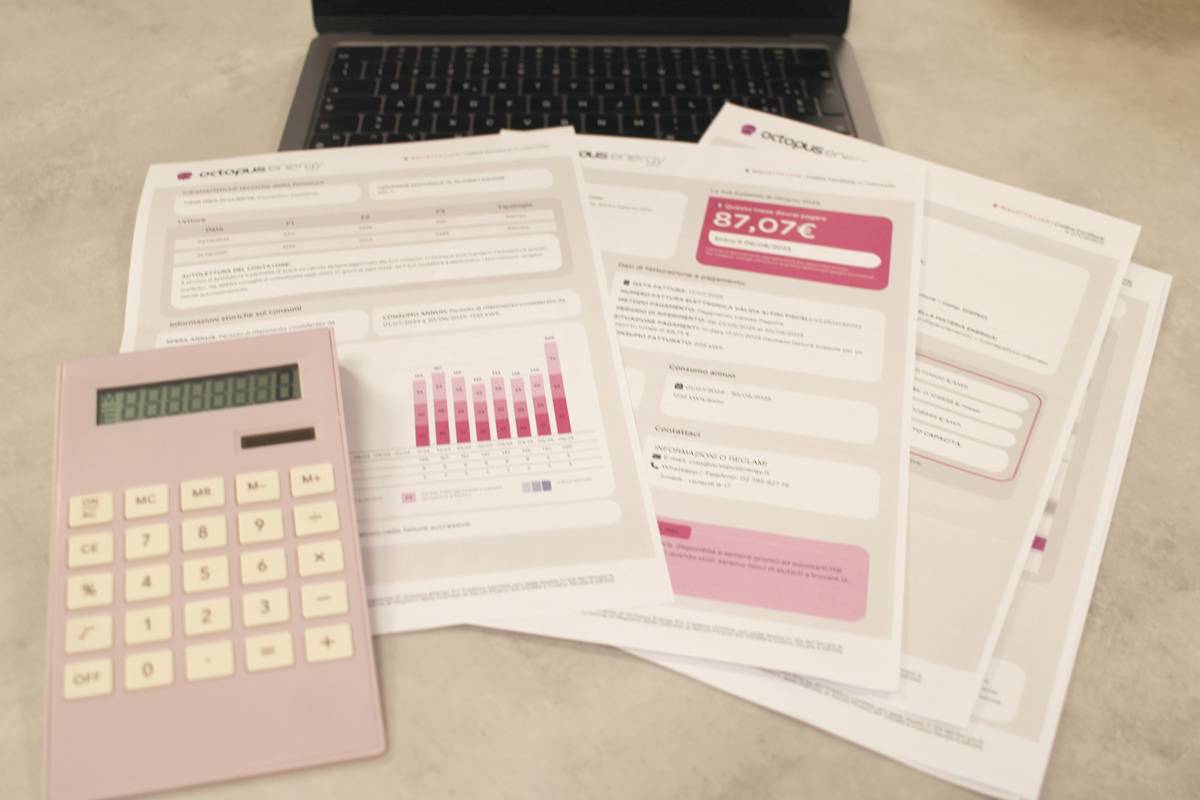

- List Your Debts: Write down all debts, including balances, interest rates, and minimum payments. No shame zone—just facts.

- Create a Barebones Budget: Track every single expense for a month using apps like Mint or YNAB (You Need A Budget).

- Prioritize High-Interest Debts: Use the avalanche method (pay off highest-interest debts first) or snowball method (smallest balance first).

- Automate Payments: Automating ensures you never miss a payment and avoid late fees.

- Review Regularly: Adjust as needed. Life changes, so should your budget.

Best Practices to Avoid Common Pitfalls

Pro Tip Alert

One terrible tip floating around online says, “Just stop spending entirely!” While technically true, it’s unrealistic and unsustainable. Instead, focus on sustainable habits:

- Cut non-essentials temporarily but allow yourself occasional treats.

- Consider enrolling in budgeting courses—they offer structured learning paths.

- Talk openly about finances with trusted friends; accountability matters.

Rant Zone: Stop Ignoring Late Fees!

Does paying late feel rebellious? Spoiler alert—it costs way more than rebellion is worth. Those pesky $35 overdraft fees add up faster than you’d believe.

Real-Life Success Stories

Meet Sarah, a teacher from Ohio who tackled $50,000 in student loans using strict budgeting tactics combined with debt management courses. She cut cable, stopped eating out, and even started a side hustle selling handmade crafts online. Within three years, she was completely debt-free.

FAQs About Budgeting to Eliminate Debt

Do I Really Need a Course for Budgeting?

No, but it helps. Budgeting courses break down complex topics into digestible lessons while providing peer support.

How Long Does It Take to See Results?

Typically 3–6 months before significant progress becomes noticeable.

Can I Still Have Fun While Paying Off Debt?

Absolutely. Balance is key—just be mindful of frivolous spending.

Conclusion

Eliminating debt isn’t easy, but it’s entirely possible with the right approach. By mastering budgeting techniques and staying disciplined, you’ll transform your financial future. Ready to take the plunge? Remember, progress takes time, but consistency wins the race.

Here’s a little haiku to keep you motivated:

Numbers may seem daunting,

But hope lies within the math,

Debt-free days ahead.