Ever stared at your student loan balance and wondered if you’d still be paying it off when your grandkids graduate? Yeah, us too. With the average student loan debt hovering around $37,000 per borrower in the U.S., managing repayment feels like trying to climb Everest in flip-flops. But what if I told you that a budgeting course could turn this financial mess into something resembling order?

In this guide, we’ll explore how strategic budgeting courses can help you tackle your student loan repayment with precision—and maybe even have money left over for brunch. Buckle up because by the time you finish reading, you’ll know exactly how to take control of those pesky loans. We’ll cover:

- The crippling burden of student loans (and why ignoring them isn’t an option)

- How budgeting courses teach you to prioritize payments without losing sleep

- Actionable steps and tips to crush your debt faster than you thought possible

- Real-world examples of borrowers who’ve successfully used these strategies

Table of Contents

Key Takeaways

- Budgeting courses provide clarity on managing income vs. expenses.

- A well-planned budget ensures consistent progress toward repaying student loans.

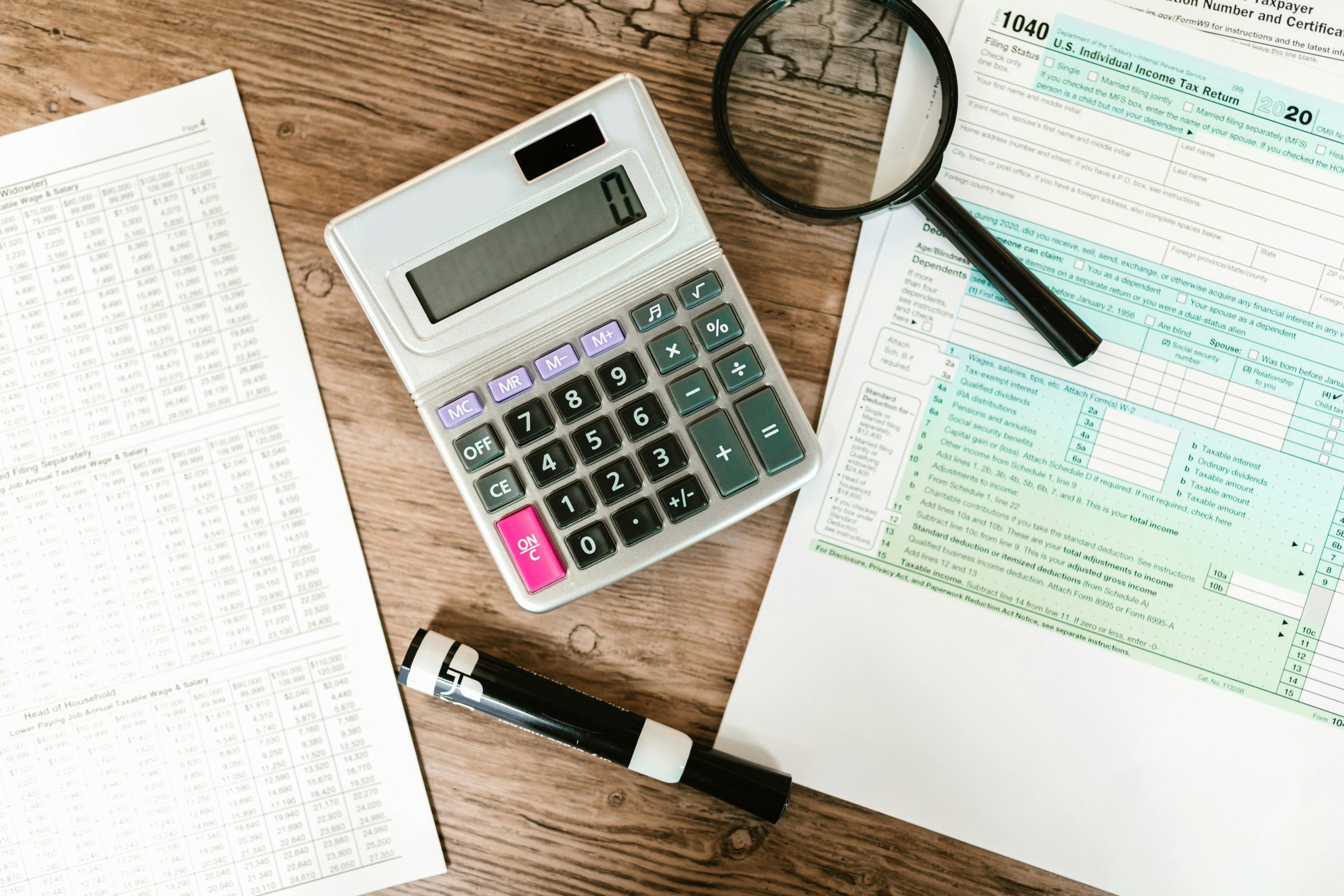

- You don’t need fancy tools; basic spreadsheets work wonders.

- Learning from others’ success stories boosts confidence and motivation.

- Ignoring repayments might feel tempting—but trust me, it’s chef’s kiss terrible advice.

What Makes Student Loans So Damn Hard To Handle?

Let’s get real for a moment. It’s easy to feel overwhelmed when every paycheck disappears into interest charges. And let’s not forget about lifestyle inflation—you finally land a decent job, only to find yourself spending more on avocado toast than savings.

“I once tried throwing all my extra cash at random bills hoping they’d magically disappear. Spoiler alert: They didn’t.” – Me, during one particularly chaotic month.

The problem lies in lack of structure. Without a solid plan, minimum payments stretch repayment timelines painfully thin. Worse yet, procrastination breeds bigger problems later. Sound familiar?

Step-by-Step Guide to Master Budgeting Courses

Why Start With a Course?

Think of budgeting courses as personal trainers for your finances. Just like a gym coach shows you proper form, these programs walk you through foundational skills such as tracking spending, prioritizing debts, and planning ahead. Here’s how to dive in:

Step 1: Find the Right Course

Not all budgeting courses are created equal. Some focus on quick wins while others emphasize long-term behaviors. Look for user reviews or free trials before committing.

Step 2: Create Your Spending Blueprint

Optimist You: “Dedicate 50% to needs, 30% to wants, and 20% to savings!”

Grumpy You: “Does anyone actually stick to this? Fine…but first, coffee.”

Step 3: Automate Payments Like a Pro

Set automatic transfers so you never miss a bill again. This way, your loans become less of a headache and more just background noise—like your laptop fan whirring softly after hours of crunching numbers.

Tips for Maximizing Your Repayment Strategy

- Cut Non-Essentials: Cancel subscriptions languishing unused. That zombie Netflix account adding up each month? Kill it.

- Negotiate Interest Rates: Don’t hesitate to call lenders and ask for better terms. Worst-case scenario? They say no.

- Side Hustles Work Wonders: Turn weekend gigs into dedicated loan slayers. Freelance writing or ride-sharing services can pad your wallet significantly.

Real-Life Success Stories

Meet Sarah: A graphic designer drowning in $50K of loans until she took a budgeting course. By restructuring her expenses and slashing unnecessary costs, she paid off her loans five years early!

FAQs About Student Loan Repayment & Budgeting Courses

Are Budgeting Courses Worth the Investment?

Yes—if they save you thousands in wasted interest payments, they’re worth their weight in gold.

Will Cutting Expenses Really Make a Difference?

Absolutely. Every dollar counts when tackling high-interest loans.

Can I DIY My Own Plan Instead of Taking a Course?

Sure, but why reinvent the wheel when experts lay out proven strategies?

Conclusion

Budgeting courses aren’t magic pills—they require effort and discipline. But armed with the right knowledge, you’ll transform overwhelming debt into manageable milestones. As always, remember: Your financial journey is unique, much like crafting the perfect Instagram caption.

Stay curious, stay caffeinated, and remember—an ounce of prevention today saves you tons of stress tomorrow. Just like that Tamagotchi you forgot to feed, neglect leads nowhere good.