Ever felt like your budget is a leaky boat and you’re just bailing water nonstop? Yeah, us too. You take the course, learn all the fancy budgeting strategies, but then reality hits—your savings plan feels impossible to track. Now imagine having tools that do the heavy lifting for you.

In this post, we’ll dive into why Savings Plan Monitoring Tools are game-changers when paired with budgeting courses. Spoiler alert: They save time, boost accountability, and make financial progress feel less like rocket science. You’ll learn how these tools work, which ones stand out, and how they can supercharge your personal finance journey.

Table of Contents

- Why Savings Plan Monitoring Tools Matter

- Step-by-Step Guide to Choosing & Using Tools

- Best Practices for Maximizing Savings Tools

- Real-Life Examples of Success Stories

- FAQs About Savings Plan Monitoring Tools

Key Takeaways

- Savings Plan Monitoring Tools automate tracking, making it easier to stick to your goals.

- Budgeting courses teach skills; monitoring tools enforce them in real-time.

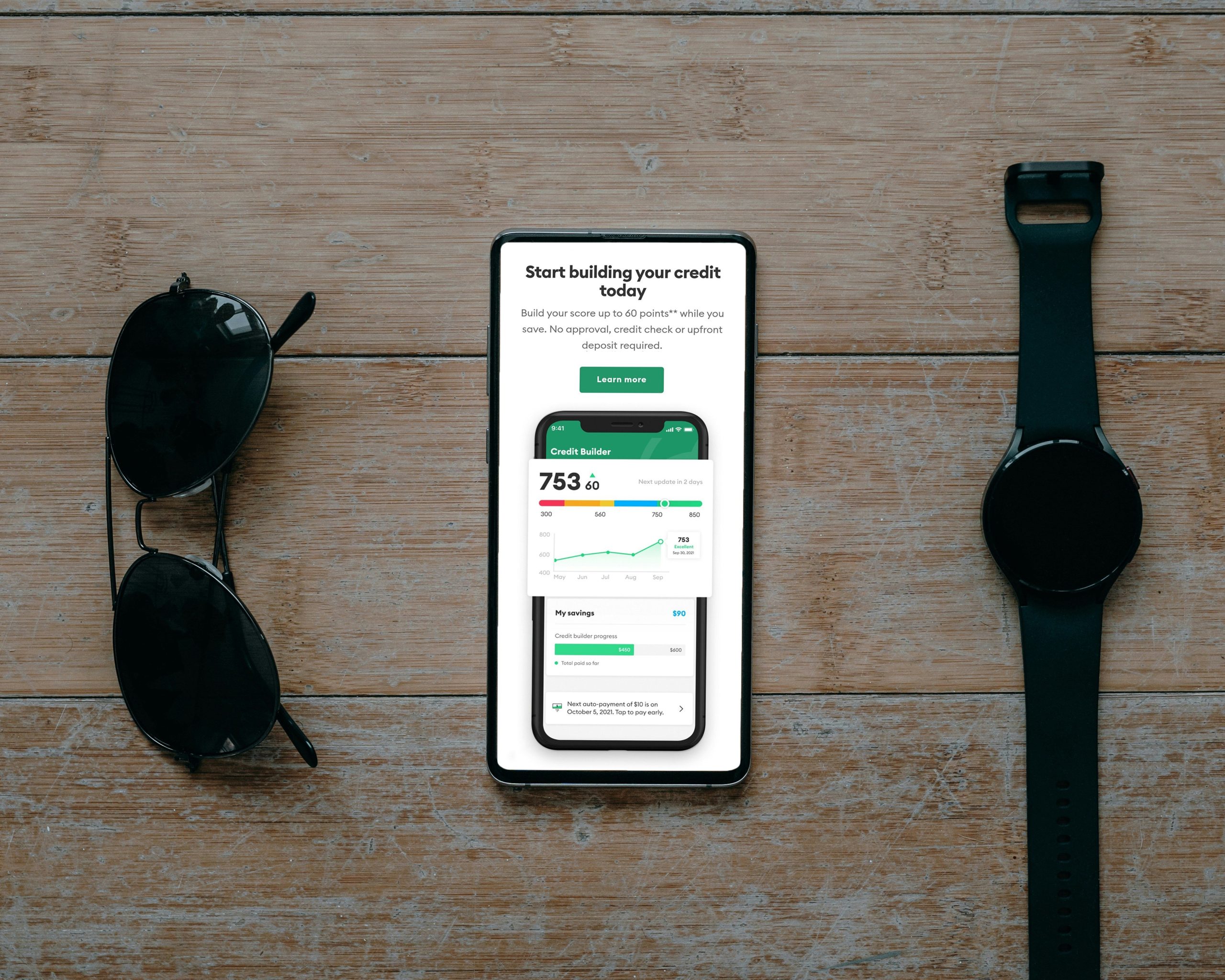

- Highly rated tools include Mint, YNAB (You Need A Budget), and PocketGuard.

- Customization is key—find a tool that aligns with your unique needs.

- Avoid “set-it-and-forget-it” mentality; active engagement is critical.

Why Savings Plan Monitoring Tools Matter

Think back to high school algebra—a problem looks unsolvable until someone hands you a calculator. Budgeting without Savings Plan Monitoring Tools feels eerily similar. Tools simplify complexity by offering clarity on where every dollar goes.

“Optimist You:” “The course said I’d be financially free within six months!”

“Grumpy You:* “Yeah, right. My spreadsheets say otherwise.”

Here’s the brutal truth: no matter how great your budgeting education is, manual tracking often leads to burnout. According to a study, nearly 60% of people who start a budget abandon it within three months due to frustration or lack of results.

Step-by-Step Guide to Choosing & Using Tools

Step 1: Assess Your Needs

Ask yourself: Do I want an app that syncs bank accounts? Should it also manage investments? Prioritize features based on your lifestyle.

Step 2: Compare Top Options

| Tool Name | Core Features | Pricing |

|---|---|---|

| Mint | Automated expense categorization, bill reminders | Free |

| YNAB | Zero-based budgeting, goal setting | $14.99/month |

| PocketGuard | Spending limits, subscription tracking | $7.99/month |

Step 3: Automate Where Possible

Scheduled alerts, automatic syncing, and AI-powered insights? That’s chef’s kiss for anyone drowning in Excel cells.

Best Practices for Maximizing Savings Tools

- Set Clear Goals: Whether it’s saving $5,000 for vacation or building an emergency fund, define targets.

- Review Weekly: Don’t ignore the updates. Make reviewing your dashboard part of your routine.

- Avoid Overcomplication: Pick one tool and stick to it instead of hopping between apps.

- (Terrible Tip): Don’t Just Trust Defaults: Customizing settings to fit YOUR life beats blindly following templates. Seriously, don’t skip this step—it’s annoyingly crucial!

Real-Life Examples of Success Stories

Tina from Texas took our advice. After completing her budgeting course, she downloaded YNAB and set up specific categories for dining out, utilities, and entertainment. Within six months, she slashed unnecessary expenses by 40%. Her secret sauce? Real-time notifications kept her accountable.

“Before, my monthly budget was more aspirational than actionable. But now, seeing exactly what I spend keeps me honest,” says Tina.

FAQs About Savings Plan Monitoring Tools

Are These Tools Safe to Link to My Bank Accounts?

Yes, most reputable tools use bank-level encryption and multi-factor authentication. Always check reviews and security protocols before linking sensitive information.

Can I Use More Than One Tool at Once?

Technically, yes. However, overlapping data might get messy. Stick to one primary tool unless absolutely necessary.

Do Free Tools Work as Well as Paid Ones?

Free options like Mint cover basics beautifully. Paid tools like YNAB shine for advanced users needing specialized support.

Conclusion

We’ve seen how Savings Plan Monitoring Tools bridge the gap between learning about budgeting through courses and actually implementing those lessons. These tools aren’t magic wands—they won’t magically fill your piggy bank—but they will help keep you consistent and informed.

So, ready to give your budget the boost it deserves? Start exploring the recommended tools today.

Like a Tamagotchi, your finances need daily care—start feeding yours smarter habits!