Ever stared at your bank account wondering where exactly your money disappeared? You’re not alone. The average person underestimates their spending by 30%. But here’s some relief—learning expense tracking techniques can turn you from a financial flop into a budgeting boss.

In this post, we’ll cover everything you need to master expense tracking techniques, including why it’s crucial for personal finance education, actionable steps to get started with tracking, tips and tools that work like magic, real-world examples, and FAQs. Let’s dive in!

Table of Contents

- Why Expense Tracking Matters More Than Ever

- Step-by-Step Guide to Mastering Expense Tracking Techniques

- 7 Proven Tips and Best Practices for Budget Mastery

- Real-Life Examples of Successful Expense Trackers

- Frequently Asked Questions About Expense Tracking Techniques

Key Takeaways

- Expense tracking isn’t just about numbers; it’s about understanding your habits and making smarter decisions.

- The best budgeting courses teach both classic methods and tech-driven approaches.

- Consistency is key when using expense tracking techniques—small tweaks add up over time.

- Leverage apps, spreadsheets, or pen-and-paper systems based on what works for YOU.

Why Expense Tracking Matters More Than Ever

Let me confess something first: I once lost $500 because I didn’t track my coffee runs. Yup, those “just one latte” trips added up faster than I could say soy milk. And trust me—it hurt worse than burning my tongue on hot cocoa.

But here’s the brutal truth: If you’re not actively tracking expenses, you’re letting bad habits dictate your financial future. That daily Starbucks run might feel harmless, but compound interest (the good OR bad kind) doesn’t discriminate. Plus, without visibility into your spending patterns, how do you expect to save for goals like travel, retirement, or even an emergency fund?

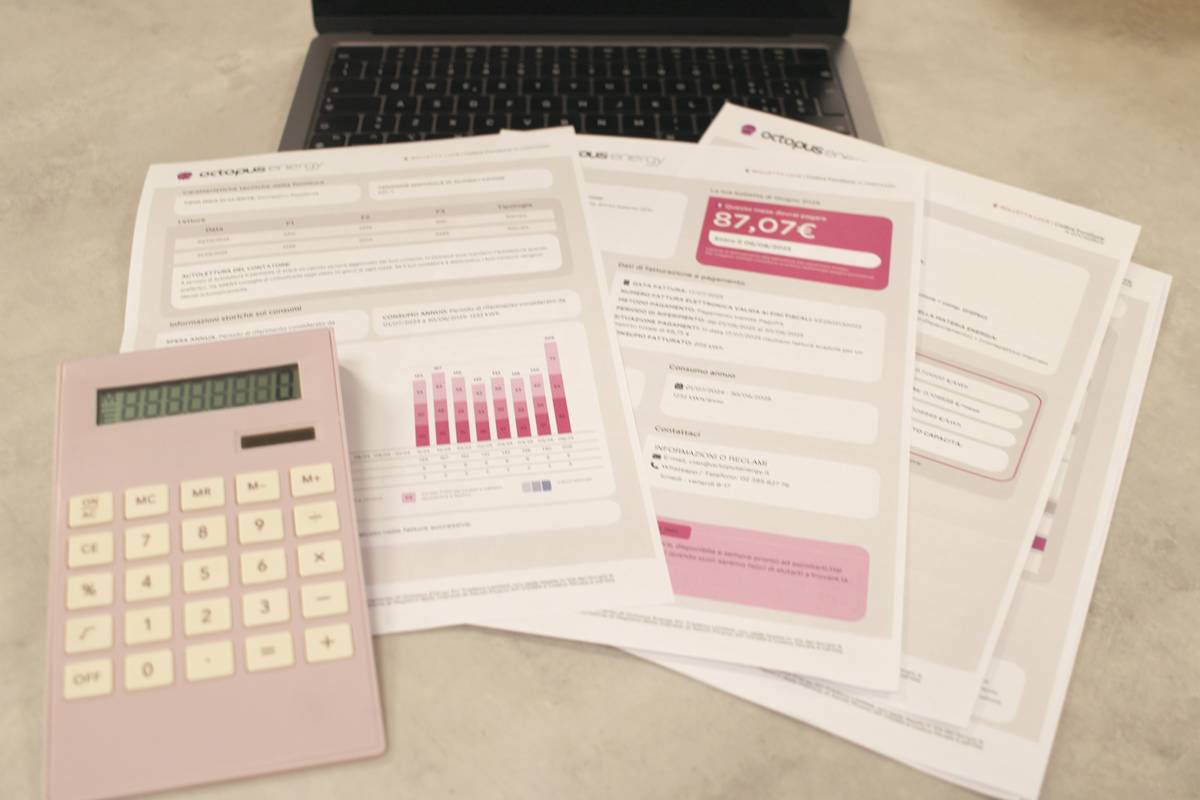

This chart highlights how most people underestimate their monthly spending—an eye-opener if there ever was one.

Step-by-Step Guide to Mastering Expense Tracking Techniques

Optimist You: “Alright, let’s crush these expenses!”

Grumpy You: “Ugh, fine—but only if there’s coffee involved.”

Step 1: Choose Your Weapon (App vs. Spreadsheet vs. Notebook)

Picking the right tool matters more than perfectionism. Whether you prefer apps like Mint or YNAB, Google Sheets formulas galore, or old-school notebooks, consistency beats complexity every time.

Step 2: Categorize Like a Pro

Create categories like Housing, Food, Entertainment, etc., so each dollar has its place. Think of them as little labels sticking to your receipts until they make sense together. It sounds mundane, but oh boy, does clarity feel chef’s kiss amazing.

Step 3: Start Small, Scale Smart

Don’t aim to overhaul all your finances overnight. Focus on tracking ONE category per week—maybe groceries or entertainment—and build momentum gradually. This avoids burnout and keeps morale high.

7 Proven Tips and Best Practices for Budget Mastery

- Automate Savings First: Set aside money before you’re tempted to spend it. Apps like Digit automate this process seamlessly.

- Create Visual Cues: Use sticky notes or digital reminders to nudge yourself toward mindful spending.

- Review Weekly: Dedicate 15 minutes weekly to review tracked expenses. Sounds easy, feels powerful.

- Avoid Terrible Tip Alert: DO NOT blindly copy someone else’s budget template without tweaking it for YOUR needs. One size does NOT fit all.

- Embrace Tech: Tools like PocketGuard link directly to your accounts for real-time updates.

- Reward Yourself: Treat yourself after hitting savings milestones. Call it “budgeting dessert.”

- Be Honest: No fudging numbers. Lies will sabotage your progress quicker than pizza ruins diet plans.

Real-Life Examples of Successful Expense Trackers

Tina, a freelance graphic designer, crushed her debt by using YNAB (You Need A Budget). She went from drowning in credit card bills to paying off $40k in two years—all thanks to disciplined expense tracking techniques.

And then there’s Dave, who turned his chaotic cash flow into control with Tiller Money spreadsheets. His secret? Automation + discipline = success smoother than buttery croissants.

Tina’s transformation proves consistent expense tracking leads to incredible results.

Frequently Asked Questions About Expense Tracking Techniques

Q: Is manual tracking better than automated tools?

A: Not necessarily. Manual tracking helps understand where money goes deeply, while automation offers convenience. Blend both worlds if possible!

Q: How long should I commit before seeing results?

A: Typically, 3 months is enough to see noticeable changes. Stick around longer though—real mastery blooms beyond 6 months.

Q: What’s the biggest pitfall newbies face?

A: Skipping hard truths. Facing uncomfortable spending areas stinks initially but saves heaps later.

Conclusion

We’ve walked through the importance of mastering expense tracking techniques, broken down actionable steps, shared tips and examples, and answered FAQs. Remember, consistency and honesty are king when it comes to dominating your budget game.

So go forth, friend! Equip yourself with knowledge, track those dollars, and watch your financial dreams come alive. Chef’s kiss to your future riches, okay?

Oh, and remember: Like Pikachu evolving, your wallet evolves too—with patience and practice. Catch ‘em all!