Ever felt like your money disappears faster than you can say “expense tracking spreadsheet”? You’re not alone. Most people struggle to keep tabs on their spending—and it’s costing them big time.

Budgeting courses often teach fancy strategies, but let’s be real: the foundation of financial success starts with one simple tool—an expense tracking spreadsheet. In this guide, we’ll show you how to harness its power, step-by-step. By the end, you’ll have actionable insights and a plan to master your finances once and for all.

Table of Contents

- Key Takeaways

- Section 1: The Problem with Budgeting

- Section 2: How to Build Your Expense Tracking Spreadsheet

- Section 3: Pro Tips for Getting the Most Out of Your Spreadsheet

- Section 4: Real-Life Success Stories

- Section 5: FAQs About Expense Tracking Spreadsheets

- Conclusion

Key Takeaways

- An expense tracking spreadsheet is the simplest way to monitor and control your spending habits.

- Even if budgeting courses seem overwhelming, building a spreadsheet only takes a few steps.

- Automation tools can sync your spreadsheet with bank accounts for hands-free updates.

- Real-life examples prove that consistent use leads to massive savings over time.

Section 1: The Problem with Budgeting

Budgeting feels impossible when you don’t know where your money goes. According to a recent survey, nearly 60% of Americans live paycheck to paycheck, largely because they lack visibility into their expenses.

Here’s my confessional fail moment: I once tried using a budgeting app recommended by a course. After religiously logging every coffee order and grocery trip, I realized… I was still broke at the end of the month! What happened? Simple—I didn’t categorize my expenses properly. No wonder everything felt chaotic.

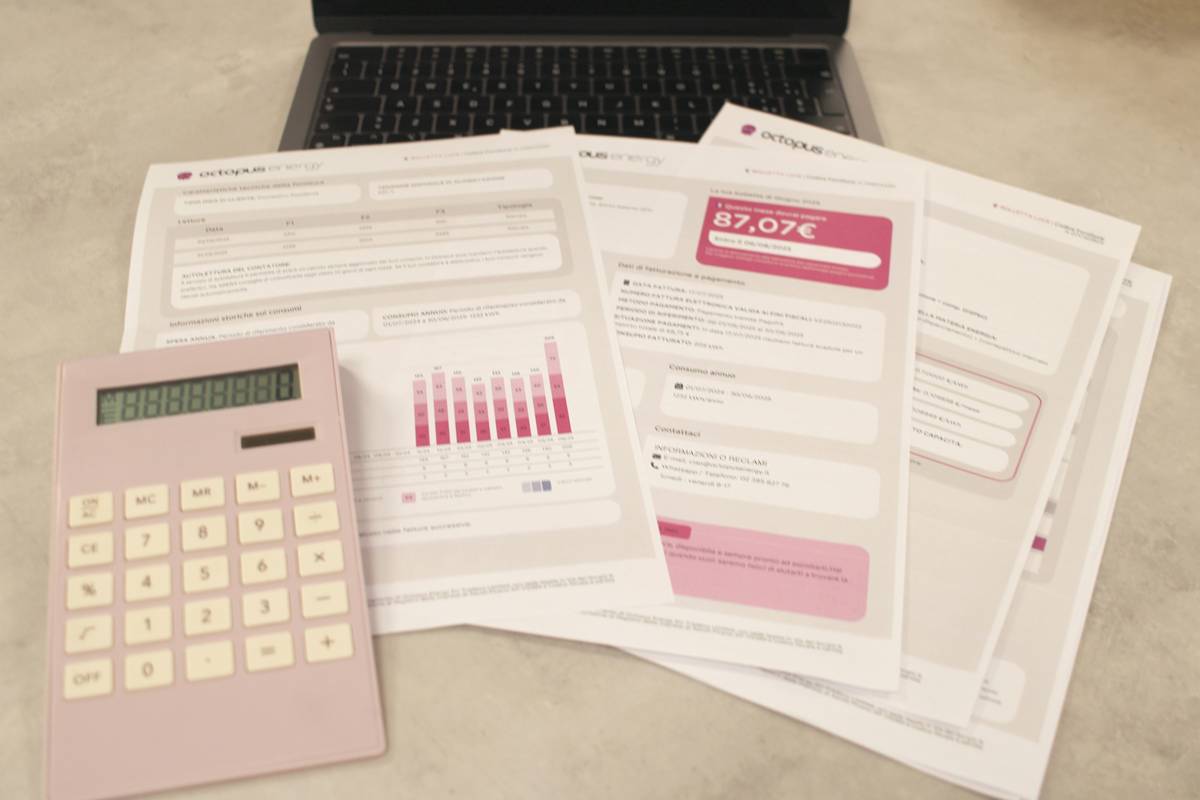

A visual representation of why so many struggle with budgeting—it’s hard to track without a system!

The Good News

There’s light at the end of the tunnel. An expense tracking spreadsheet lets you customize categories, visualize trends, and stay accountable—all without overcomplicating things.

Section 2: How to Build Your Expense Tracking Spreadsheet

Ready to dive in? Follow these steps:

Step 1: Choose the Right Tool

Whether you prefer Excel, Google Sheets, or even Notion, pick a platform you feel comfortable with. (Pro tip: Google Sheets has free templates!)

Step 2: Set Up Key Columns

Your basic layout should include:

- Date

- Description of Purchase

- Category (e.g., Groceries, Entertainment)

- Amount Spent

- Payment Method

Step 3: Customize Categories

Don’t just stick to generic labels—get specific! Instead of “Food,” try “Grocery Shopping vs. Takeout.” This granular approach helps pinpoint problem areas.

Step 4: Automate Where Possible

Sync your spreadsheet with apps like Mint or YNAB to automatically pull in transactions. Saves hours and reduces human error—chef’s kiss!

![]()

This template organizes data into intuitive sections for easy navigation.

Section 3: Pro Tips for Getting the Most Out of Your Spreadsheet

Tip #1: Use Conditional Formatting

Set up color-coded cells to highlight overspending instantly. Sounds like magic, right?

Tip #2: Review Monthly Trends

Create pivot tables or charts to see spending patterns. Visuals are much easier to digest than raw numbers.

Terrible Tip Alert:

“Just wing it!” Nope, don’t skip planning your categories. A poorly structured sheet will leave you more confused than before.

Section 4: Real-Life Success Stories

Tina from Chicago saved $2,500 in six months simply by tracking her dining-out expenses. She switched to cooking at home 80% of the time and watched her bank account grow.

John from Austin cut his entertainment costs by half after analyzing his subscription services. Turns out he was paying for three streaming platforms he rarely used—oops! Now his entertainment budget funds weekend road trips instead.

Proof that small changes add up—Tina went from zero savings to thriving financially.

Section 5: FAQs About Expense Tracking Spreadsheets

Q1: Do I Need Advanced Tech Skills to Create One?

Nope. Even basic knowledge is enough to set up a functional spreadsheet.

Q2: Can I Track Joint Expenses as a Couple?

Absolutely. Just add separate columns for each person’s contributions.

Q3: Is It Worth Investing Time in a Spreadsheet When Apps Exist?

You grumpy optimist types always ask this! While apps are convenient, spreadsheets give you full control and flexibility. So yes, invest the time—it pays off.

Conclusion

There you go—a complete roadmap to mastering your finances through an expense tracking spreadsheet. Remember, personal finance isn’t about perfection; it’s about progress. Start today, take baby steps, and watch your savings soar.

And finally—a haiku for ya:

Rows and columns hum, Expenses tamed, peace restored— Budget now sings joy!

*This guide brought to you by caffeine-driven enthusiasm and nostalgia for those early MS Excel days.* 😉