Ever stared at your debt numbers and felt like you’re drowning? You’re not alone. Millions struggle to find clarity when it comes to tackling their financial burdens. But what if there was a way to create a game plan that actually works? Enter the debt payoff timeline course. In this post, we’ll explore how these courses are designed to equip you with actionable strategies for budgeting success. You’ll learn about their value, how to pick the right one, practical tips for success, and real-life examples to inspire your journey. Plus, I’ll share my biggest money-management oops moment (spoiler: it involves pizza).

Table of Contents

- Why Debt Payoff Timeline Courses Matter

- Step-by-Step Guide to Choosing the Right Course

- Best Practices to Get the Most Out of Your Course

- Real-World Examples of Success Stories

- Frequently Asked Questions About Debt Payoff Courses

Key Takeaways

- A debt payoff timeline course helps you break down overwhelming debt into manageable steps.

- Not all courses are created equal; research and reviews matter.

- Pair structured learning with real-life habits for maximum impact.

- Budgeting consistency is key—no shortcuts!

Why Debt Payoff Timeline Courses Matter

“Optimist You:” “I’ve got this! I’ll just pay off $5K in six months.”

“Grumpy You:” “Ugh, until life happens and blows up my spreadsheet.”

Here’s the deal: Without a clear strategy, paying off debt feels like chasing shadows. A recent study found that nearly 80% of Americans live paycheck to paycheck, often juggling credit card balances alongside student loans and mortgages. For me personally, I once spent an entire year trying to tackle my debt without any structure—it felt like running on a treadmill set to max speed. Spoiler alert: It didn’t work.

Enter the lifesaver: A debt payoff timeline course. These programs provide frameworks tailored to your unique situation. They teach you how to prioritize payments, negotiate interest rates, and build a realistic timeline for becoming debt-free. By using proven methodologies, they turn abstract goals into concrete plans.

Step-by-Step Guide to Choosing the Right Debt Payoff Timeline Course

Step 1: Identify Your Goals

Before jumping into a course, ask yourself: What’s my endgame? Is it eliminating high-interest credit cards first? Or consolidating multiple debts under one payment? Clarity here will help you narrow down options.

Step 2: Research Reputable Providers

Don’t fall for flashy ads promising “debt freedom overnight”—this ain’t magic. Look for courses with transparent pricing, positive user testimonials, and instructors who have verifiable expertise in personal finance. Trust me; I once signed up for a “guaranteed results” program only to discover it was pure fluff wrapped in buzzwords. Lesson learned: Dig deep before committing.

Step 3: Evaluate Content Structure

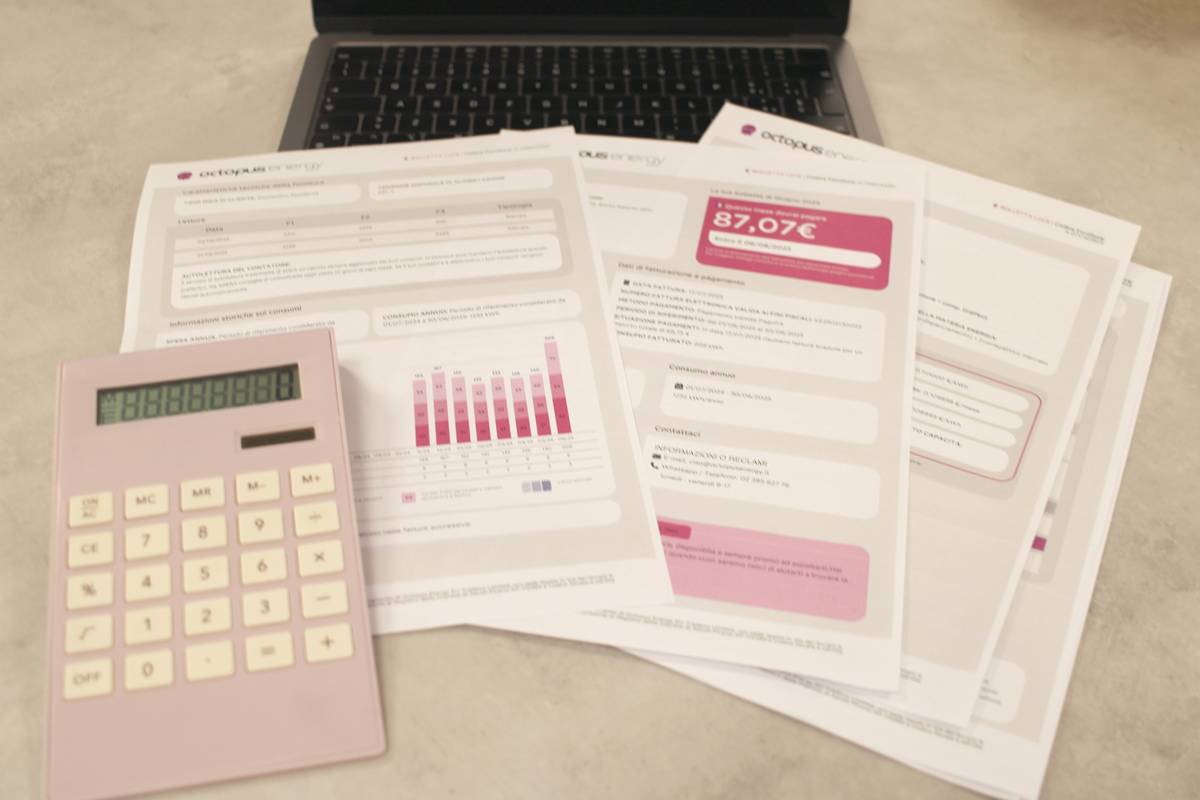

A great course offers modules that progress logically—from foundational principles to advanced tactics. Check previews or free trials if available. Bonus points for interactive tools like worksheets or calculators!

Step 4: Consider Pricing vs. Value

No shame in budget-friendly education, but remember: Cheap doesn’t always mean better. A slightly pricier course might offer lifetime access or personalized coaching, which could be worth every penny.

Best Practices to Get the Most Out of Your Debt Payoff Timeline Course

- Stick to Weekly Action Plans: Break bigger tasks into smaller, weekly milestones. Consistency beats perfection.

- Automate Payments Where Possible: Set reminders or automate payments so nothing slips through the cracks.

- Monitor Progress Regularly: Review your progress monthly. Celebrate small wins—it keeps morale high!

- (TERRIBLE TIP DISCLAIMER): Ignore Credit Score Obsession: While monitoring credit health is important, don’t obsess over minor fluctuations while ignoring actionable repayment steps.

Real-World Examples of Success Stories

Meet Sarah, a single mom from Texas who wiped out $25K in debt within two years after taking a reputable debt payoff timeline course. She credits her success to creating visual timelines and sticking to biweekly budget checks.

Frequently Asked Questions About Debt Payoff Courses

Q1: Are debt payoff timeline courses worth the investment?

Absolutely—if they align with your needs and deliver actionable insights. Think of it as hiring a financial coach minus the hourly rate.

Q2: How long does it typically take to see results?

Results vary based on factors like income, debt load, and discipline. However, many users report noticeable progress within the first three months.

Q3: Can beginners benefit from these courses?

Yes! Many courses cater specifically to novices by breaking concepts into digestible chunks.

Conclusion

If you’re tired of feeling stuck in a cycle of debt, investing in a debt payoff timeline course could be your ticket to financial empowerment. With structured guidance, practical tools, and a sprinkle of determination, you CAN crush those balances for good. So grab some coffee, roll up your sleeves, and let’s get to work. Oh, and PS—order a pizza afterward because… balance.

Like a Tamagotchi, your finances need daily care to thrive.