“Ever stared at your bank account and thought, ‘Where did all my money go?’ Yeah, we’ve been there.”

You’ve decided to take control of your finances by enrolling in budgeting courses—great move! But here’s the twist: mastering those courses means more than just reading materials or watching tutorials. If you’re not tracking where every penny goes, you’re leaving money (literally) on the table.

In this deep-dive post, we’ll uncover why expense tracking software should be your new best friend when leveling up through budgeting courses. Expect actionable advice, brutal honesty about what doesn’t work, and some quirky wisdom along the way.

Table of Contents

- Key Takeaways

- Why Expense Tracking Matters in Budgeting Courses

- How to Use Expense Tracking Software Effectively

- Best Practices for Maximizing Your Software

- Real-Life Success Stories

- Frequently Asked Questions

- Conclusion

Key Takeaways

- Expense tracking software transforms vague spending habits into clear insights.

- Pairing it with budgeting courses amplifies financial literacy.

- Picking the wrong software can lead to frustration—choose wisely!

- Avoid manual logs; they’re tedious and prone to errors.

Why Expense Tracking Matters in Budgeting Courses

Here’s a hard truth: no matter how many budgeting strategies you learn from courses, none will stick unless you see real-world application. And that’s where expense tracking software comes in.

I once tried doing budgeting without any tools—it was like trying to write a novel using only sticky notes. Chaos doesn’t even begin to describe it. I forgot recurring subscriptions, overestimated “miscellaneous” costs, and completely ignored impulse buys. Ugh.

This confessional fail taught me one thing: humans suck at remembering transactions accurately. Enter expense tracking software. It takes the guesswork out of understanding cash flow so you can focus on applying lessons from your courses effectively.

Credit: An illustration comparing messy manual budgeting methods versus automated expense tracking systems.

Optimist You:

“Using expense trackers means I’ll finally understand my spending patterns!”

Grumpy You:

“But first, let me download half the apps in the app store before picking the right one—sigh.”

How to Use Expense Tracking Software Effectively

Now that you know *why* expense tracking software matters, let’s talk about *how* to use it properly. Yes, there’s an art to this too.

Step 1: Choose the Right Software for Your Needs

Don’t fall victim to shiny object syndrome. Ask yourself:

- Do I need mobile access?

- Is integration with my bank accounts essential?

- Can the software categorize expenses automatically?

Popular options include Mint, PocketGuard, and YNAB (You Need A Budget). Each has its pros and cons depending on whether you prefer simplicity or advanced analytics.

Step 2: Set Up Automatic Syncing

Remember our cardinal rule: Don’t manually input everything. Automate as much as possible. Link your accounts securely so payments, bills, and receipts appear instantly.

Step 3: Categorize and Tag Transactions

If you skip tagging (“Wait, what’s this $47.50 charge?”), you might as well toss your data into outer space. Assign categories like groceries, entertainment, utilities, etc., so your reports make sense later.

Best Practices for Maximizing Your Software

- Review Weekly: Spend 15 minutes reviewing your weekly report. Sounds like dragging nails across chalkboard? Too bad—it works.

- Set Alerts: Get notifications for unusual activity or when nearing budget limits—like hearing your smoke alarm go off, but less terrifying.

- Leverage Reports: Most platforms offer graphs and charts. These aren’t just pretty visuals—they help visualize areas where you overspend.

Terrible Tip Alert:

Thinking spreadsheets are “good enough”? Trust me, they aren’t. Manual inputs breed mistakes faster than mold grows on bread.

Rant Section: Why Generic Apps Stink

Let me vent—generic apps promising miracles give me hives. They overload you with features you don’t need while ignoring basics like intuitive navigation. The worst offenders? Apps that bombard you with ads for premium upgrades mid-task. Chef’s kiss levels of annoying.

Real-Life Success Stories

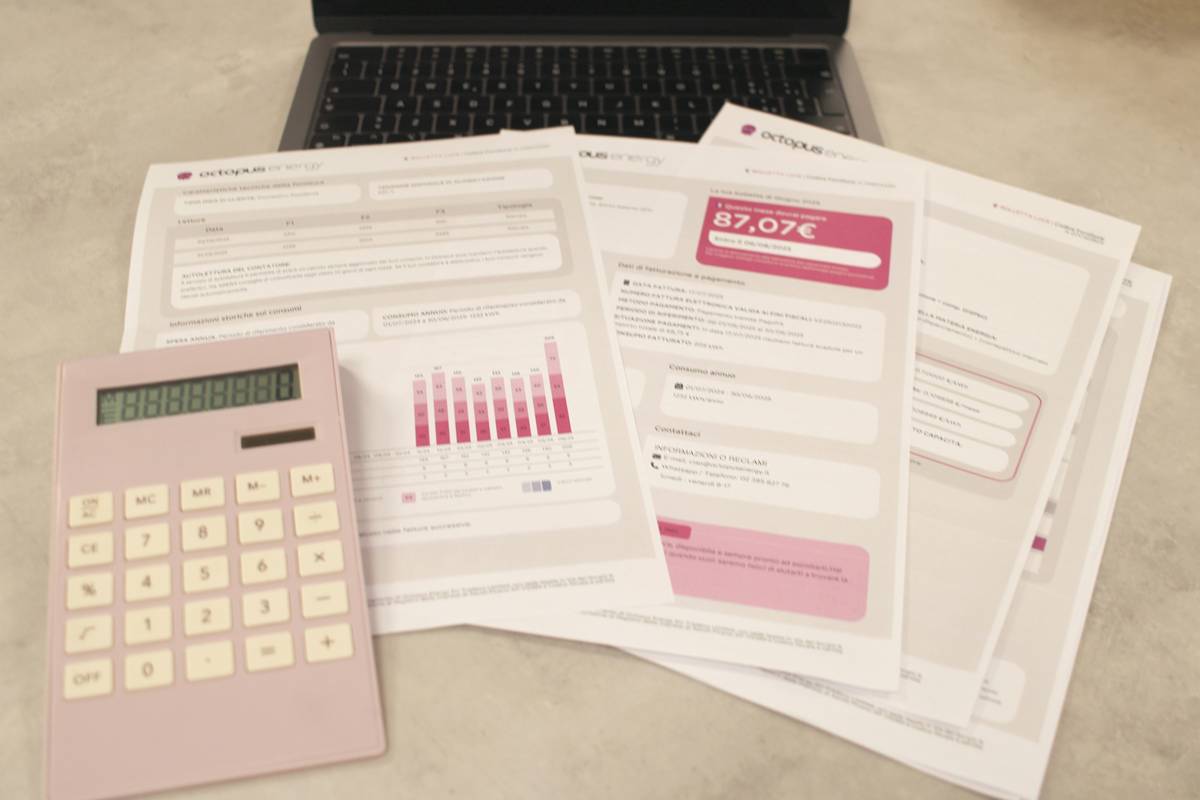

Taking Sarah’s example, who enrolled in a popular online budgeting course last year. She paired her coursework with Mint, setting aside $50 weekly strictly through thoughtful adjustments flagged by the software. Within six months, she saved enough for a vacation—and never missed a bill payment again.

Credit: A visual representation of improved savings after implementing effective expense tracking alongside education.

Frequently Asked Questions

Q: What’s the difference between free and paid expense tracking software?

A: Free versions often lack advanced features like investment tracking or custom reporting. Paid plans typically provide better integrations and customer support.

Q: How secure is linking my bank account to these apps?

A: Reputable providers use encryption and multi-factor authentication. Still, always check reviews and terms of service.

Q: Can kids benefit from learning about expense tracking early?

A: Absolutely! Teaching teens basic financial skills prepares them for adulthood—a true life hack.

Conclusion

Budgeting courses empower us with knowledge, but expense tracking software gives us supercharged execution. Whether you’re dodging unnecessary subscriptions or fine-tuning your grocery budget, pairing both resources amplifies success.

Like Mario collecting power-ups, combining education with tech creates unstoppable momentum toward financial freedom.

Final Thought Haiku:

Numbers tell a tale,

Track expenses daily—boom!

Budget mastery.