Table of Contents

- Introduction: Why Budgeting for Debt Settlement is a Game-Changer

- The Problem with Debt—and How Budgeting Saves the Day

- Step-by-Step Guide to Budgeting for Debt Settlement

- Tips and Best Practices for Crushing Debt

- Real-Life Examples: People Who Won at Budgeting for Debt Settlement

- Frequently Asked Questions About Budgeting for Debt Settlement

- Conclusion: Take Action Today!

Why Budgeting for Debt Settlement is a Game-Changer

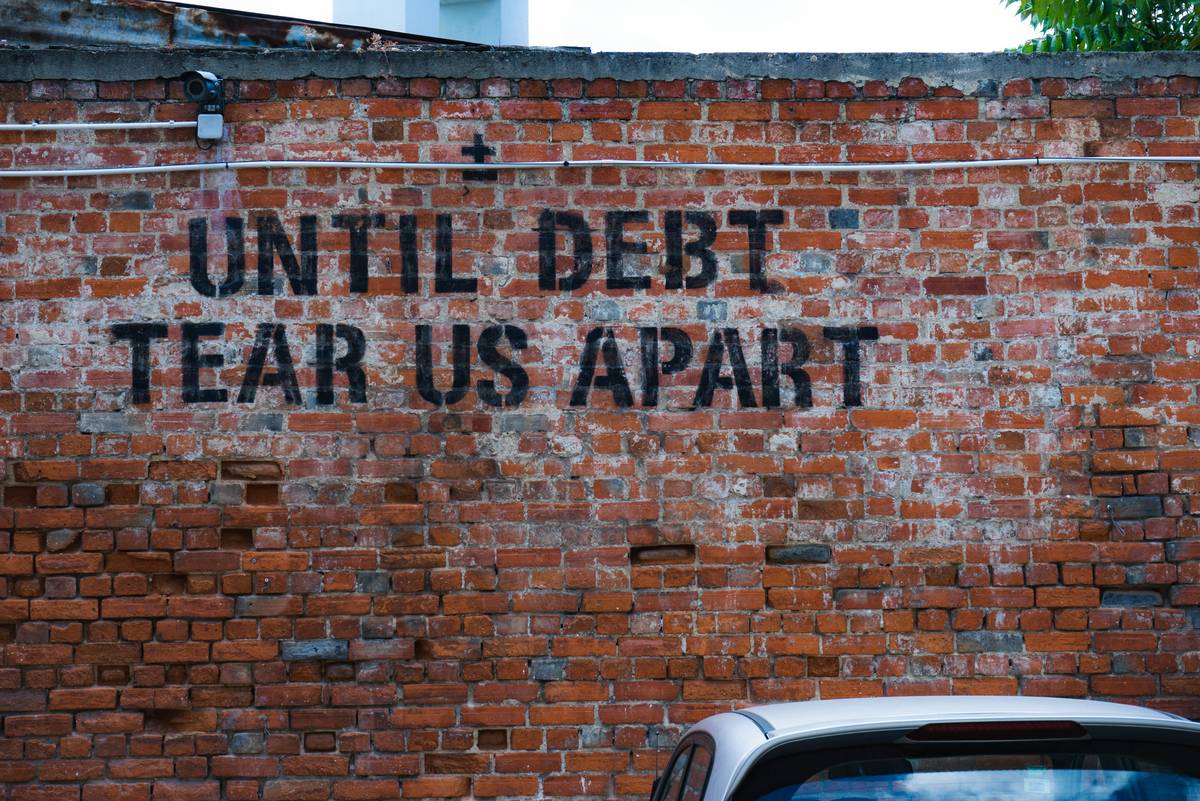

Ever felt like you’re drowning in debt—like your paycheck disappears faster than coffee on a Monday morning? You’re not alone. According to the Federal Reserve, Americans collectively owe over $1 trillion in credit card debt alone. Yikes. But here’s the silver lining: mastering the art of budgeting for debt settlement can turn things around.

In this post, we’ll dive into why budgeting for debt settlement isn’t just “nice to have” but an absolute necessity. You’ll learn:

- The harsh reality of unmanaged debt (and why budgets are your lifeline).

- A foolproof step-by-step guide to creating a budget tailored to settling debts.

- Tips from financial pros that will save you time and stress.

- Real stories of people who crushed their debt using these techniques.

The Problem with Debt—and How Budgeting Saves the Day

Let’s get real for a second. I once racked up $5,000 in credit card debt buying avocado toast—a move so millennial it hurts. It took months of sleepless nights before I realized there was no magic wand; I needed a plan. That’s where budgeting came in.

Without a solid budget, debt spirals out of control. Late fees pile up, interest rates soar, and suddenly your minimum payments feel like climbing Mount Everest in flip-flops. *Ugh.*

But here’s the tea: budgeting doesn’t just organize your money—it gives you power. When you budget specifically for debt settlement, every dollar has purpose. And when done right, it’s chef’s kiss for knocking out those IOUs.

Why Traditional Budgets Fail (and What to Do Instead)

Optimist You: “Just follow Dave Ramsey’s envelope system!”

Grumpy Me: “Ugh, fine—but only if coffee’s involved.”

The truth? Generic budgets don’t account for the chaos of life. If all you’re doing is tracking expenses without prioritizing debt settlement, you’re playing checkers while your debt plays chess.

Step-by-Step Guide to Budgeting for Debt Settlement

Step 1: Assess Your Financial Situation

List EVERYTHING: income, expenses, debts, assets—even that old gym membership you never use. Seeing the whole picture helps prioritize what needs attention first.

Step 2: Set Clear Goals for Debt Settlement

Ask yourself: Do I want to settle one big debt or chip away at multiple smaller ones? For example, the Snowball Method focuses on small victories, while the Avalanche Method targets high-interest debts.

Step 3: Trim Fat From Your Expenses

This part stings. Ditch subscriptions, eat ramen instead of ordering Postmates, and start thrifting. Trust me, your future self will thank you.

Step 4: Automate Payments

Setting up auto-pay ensures consistency. Bonus points if you schedule payments right after payday so you don’t “accidentally” spend the money elsewhere.

Step 5: Track Progress Like Your Life Depends On It

Use apps like Mint or YNAB (You Need A Budget) to stay accountable. Watching your debt shrink feels better than watching Netflix binge-worthy series.

Tips and Best Practices for Crushing Debt

- Talk to Creditors: Sometimes they’ll lower your interest rate if you explain your situation.

- Prioritize High-Interest Debts: This saves you money in the long run.

- Say No to Lifestyle Creep: Once you make more money, resist upgrading everything immediately.

- Create Emergency Savings: Because life happens, and Murphy’s Law loves debtors.

- Stay Consistent: Rome wasn’t built overnight, and neither is a debt-free existence.

Rant Alert: Why Payday Loans Are Evil

Let’s talk about my pet peeve: payday loans. They prey on desperation and often come with insane interest rates. Avoid them like expired sushi. Seriously.

Real-Life Examples: People Who Won at Budgeting for Debt Settlement

Case Study #1: Sarah K., Freelancer

Sarah had $20,000 in student loans and another $8,000 in credit card debt. By switching to freelance work and cutting her grocery bill by half, she paid off ALL HER DEBT in three years. Her secret? Treating her debt repayment plan like a business expense.

Case Study #2: Mike T., Retail Worker

After getting laid off during the pandemic, Mike found himself drowning in medical bills. Using the Snowball Method, he tackled the smallest bills first, building momentum until his largest debt ($15k) felt manageable.

Frequently Asked Questions About Budgeting for Debt Settlement

Q1: Can I settle debt without hurting my credit score?

Short answer: Yes—and no. While some settlements may ding your score temporarily, consistent payments and reducing overall debt will help rebuild it over time.

Q2: Should I hire a professional or DIY?

If you’re overwhelmed, consider hiring a certified counselor. Otherwise, many tools (like NerdWallet) offer DIY solutions.

Q3: Is there a terrible tip I should absolutely avoid?

Yes: Borrowing MORE money to pay off existing debt. Unless you’ve got a foolproof escape plan (spoiler: you probably don’t), this creates a vicious cycle.

Conclusion: Take Action Today!

Budgeting for debt settlement might sound intimidating, but remember: small actions lead to massive results. Whether you adopt the Snowball Method, automate payments, or negotiate better terms, taking charge of your finances starts now.

Pro tip: Treat your budget like a Tamagotchi. Feed it regularly, nurture it daily, and watch it thrive.

Haiku for the road:

Debt weighs us down.

Budget lifts the heavy chains.

Freedom tastes sweet.