Ever tried budgeting apps that promised to “track everything for you,” only for them to miss half your expenses? Yeah, manual expense tracking isn’t sexy—it’s slow, meticulous, and feels like filing taxes while juggling flaming swords. But here’s the kicker: it works wonders when done right.

In this guide, we’ll unpack why manual expense tracking is a game-changer for mastering personal finance—especially if you’re diving into budgeting courses. We’ll walk through its benefits, step-by-step tips, common mistakes, and yes—a little rant about how modern tools fail us sometimes. By the end, you’ll see why this old-school tactic isn’t going anywhere.

You’ll learn:

- Why manual expense tracking beats automated apps (no matter what Silicon Valley says).

- A simple step-by-step process to master the art of detailed tracking.

- Bonus tips from my own embarrassing financial missteps (spoiler alert: I once double-counted coffee receipts).

Table of Contents

- The Problem with Modern Budgeting Tools

- Step-by-Step Guide to Manual Expense Tracking

- Tips and Best Practices for Success

- Real-Life Success Stories Using Manual Expense Tracking

- Frequently Asked Questions About Manual Expense Tracking

Key Takeaways

- Manual expense tracking helps uncover expenses automation often misses.

- You’ll develop better spending habits by engaging actively with your finances.

- It’s an essential skill covered in many budgeting courses—so don’t skip it!

The Problem with Modern Budgeting Tools

Let’s get real: Automated tools are convenient, but they’re also lazy AF at catching nuances. For instance, do you categorize that $8 latte as “Food & Drinks” or “Self-Care”? Most apps slap a random label on it, leaving you clueless about your real spending patterns.

I used to trust one app so blindly that I didn’t realize I’d spent over $500 on takeout coffee in three months. Seriously, $500? My grumpy inner accountant nearly staged a coup.

“Optimist You:” Oh come on, just let the robots handle it!

“Grumpy You:” Ugh, fine—but only until they start charging subscription fees.

Step-by-Step Guide to Manual Expense Tracking

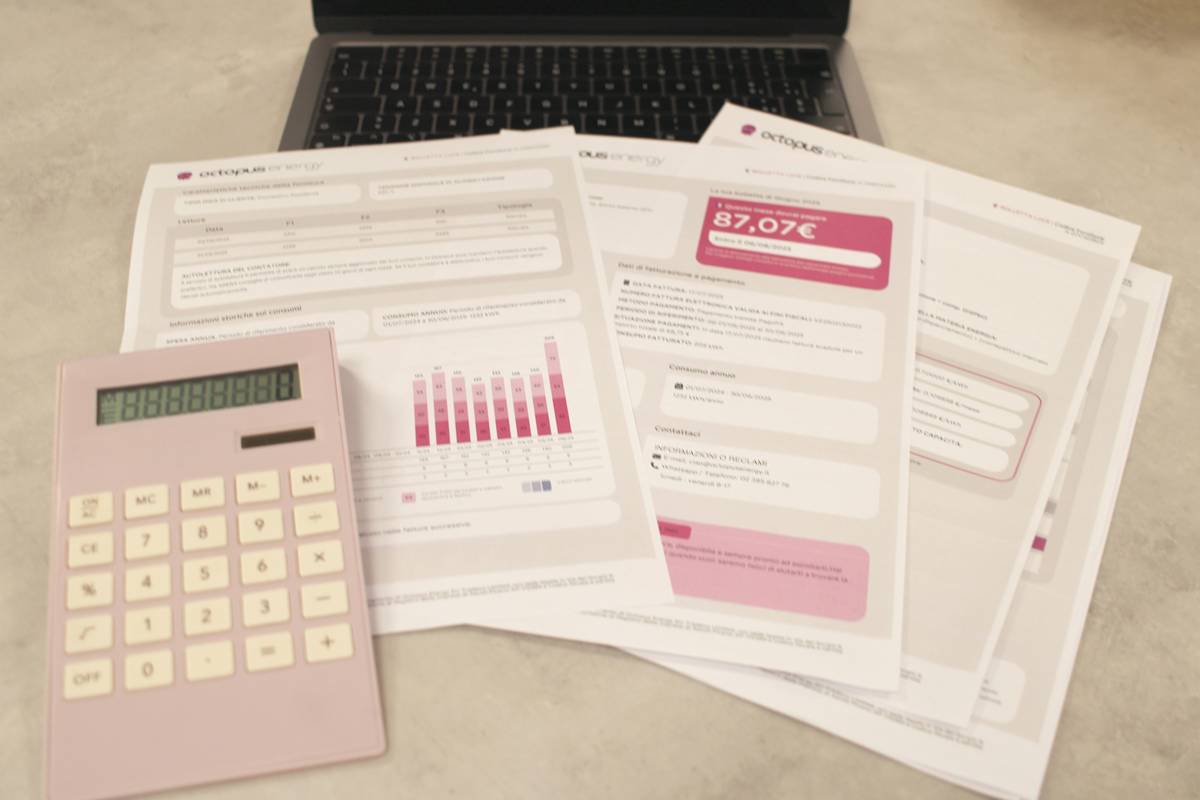

Step 1: Choose Your Weapon

Pick a medium where you feel most comfortable recording expenses—paper notebooks, Google Sheets, Excel, or even Notion. Pro tip: Paper feels tactilely satisfying but isn’t searchable. Digital methods win for data analysis later.

Step 2: Set Up Categories

Create categories tailored to YOUR life, not someone else’s defaults. Common ones include:

- Housing (rent/mortgage)

- Groceries

- Transportation

- Dining Out

- Entertainment

Step 3: Log Everything Immediately

No excuses. If you buy gum, write it down. Sounds tedious? It is—but hearing your bank account sigh with relief makes it worth it.

Step 4: Review Weekly

Spend 15 minutes every Sunday reviewing your entries. Ask yourself: Do these purchases align with my goals? Where can I cut back?

Tips and Best Practices for Success

Bad Tip Alert:

“Use highlighters to make your notebook look pretty!” Um, no. This is finance—not kindergarten arts-and-crafts.

Proven Tips:

- Be Honest: Don’t fudge numbers; it defeats the purpose.

- Automate Depreciable Items: Use automatic reminders for recurring expenses like subscriptions, then manually note them monthly.

- Use Symbols: Mark impulse buys with a star (*). Seeing these stack up might deter future splurges.

Real-Life Success Stories Using Manual Expense Tracking

Maria from Chicago saved $2,000 in six months after realizing she was blowing her paycheck on monthly beauty boxes. She tracked each box delivery manually, realized she rarely used half the products, and canceled the subscription.

Meanwhile, Jake in Sydney reduced his dining-out costs by 70% simply by logging every meal out. His before/after charts showed dramatic improvements within two months.

Frequently Asked Questions About Manual Expense Tracking

Q: Isn’t manual tracking too time-consuming?

Absolutely—it takes effort. However, think of it as investing time upfront for long-term savings. Plus, once you form the habit, it becomes second nature.

Q: Can I combine manual and automated methods?

Totally legit strategy. Use apps for routine bills and transfers, then manually record discretionary spending for a balanced approach.

Q: What happens if I forget to log something?

All is not lost. Estimate based on similar purchases, mark it clearly as an estimate, and vow to stay vigilant moving forward.

Conclusion

Manual expense tracking might sound daunting initially, but it’s the unsung hero of personal finance management. Pair it with solid budgeting courses, and you’ll not only track expenses—you’ll transform bad habits and build lasting wealth.

So grab your pens, spreadsheets, or whatever floats your boat—and get started today. After all…

“Like a Tamagotchi, your finances need daily care,

Neglect them too long, and debt starts to scare.”

– A Grumpy Optimist Haiku

#FinanceGoals