Ever stared at your bank statement like it’s written in hieroglyphics? Yeah, us too. But here’s the kicker: 60% of people who take budgeting courses still struggle with expense tracking. Why? Because they skip one crucial step—finding the perfect expense tracking app. Today, we’ll guide you through everything you need to know about leveraging these tools to master budgeting and crush your financial goals.

Table of Contents

- Key Takeaways

- The Expense Tracking Epidemic

- How to Choose Your Expense Tracking App

- Pro Tips for Maximizing Expense Trackers

- Real-World Success Stories

- Frequently Asked Questions

Key Takeaways

- An expense tracking app is your secret weapon for sticking to a budget learned in personal finance courses.

- Picking the wrong tracker can feel like chasing shadows—find one tailored to your needs.

- Tips include syncing receipts automatically, categorizing expenses, and reviewing reports weekly.

- Fail-proof strategies from real-world success stories will inspire even the most stubborn spenders.

The Expense Tracking Epidemic

Picture this: You enroll in an amazing online budgeting course (because, adulting), but halfway through, you realize tracking every latte feels like herding cats. Confession time—I once tried using a spreadsheet so complicated that my laptop overheated. Sounds familiar?

Your laptop screaming, “No more spreadsheets!”

Personal finance education teaches you how to allocate funds, invest wisely, and avoid debt spirals—but without solid execution, knowledge gathers virtual dust. That’s where the right expense tracking app swoops in as the superhero no capes deserved.

How to Choose Your Expense Tracking App

“What Makes an Expense Tracker Worth It?” Said Optimist You

Glad you asked. Here’s your step-by-step blueprint:

Step 1: Know What Features Matter Most

Does automatic receipt scanning make you giddy? Are integrations with banking apps non-negotiable? Prioritize features that align with YOUR habits.

Step 2: Free vs. Paid—Can You Have Both?

Some gems start free then hit you with premium features later (*cough* YNAB *cough*). Trial versions are lifesavers here—get hands-on before committing.

Step 3: User-Friendliness Is Non-Negotiable

If setting up the app feels harder than assembling IKEA furniture, move on. Life’s too short for confusing interfaces.

Step 4: Security Should Be Fort Knox-Level

You’re handing over sensitive data. Ensure the app uses bank-grade encryption or prepare for some major digital drama.

Grumpy Me: Ugh, I Just Want Coffee…

Fine. Let’s not forget the worst possible tip: “Download random apps because influencers swear by them.” Spoiler alert: Influencers don’t live rent-free in your head—they get paid to promote.

Pro Tips for Maximizing Expense Trackers

- Sync Receipts Automatically: No manual entry = less room for excuses.

- Categorize Expenses Early and Often: Group spending into buckets (groceries, entertainment) to see patterns faster.

- Set Alerts: Weekly reminders save you from accidental coffee binges.

- Review Reports Weekly: Seeing progress is oddly satisfying.

Rant Alert: If your app forces you to input categories manually EVERY. SINGLE. TIME., burn it. Life’s too chaotic already.

Track wisely or end up broke buying avocado toast.

Real-World Success Stories

Meet Sarah—a former impulse buyer who transformed her finances after taking a budgeting course. Her secret sauce? Mint’s integration with her bank accounts. Within months, she cut unnecessary subscriptions and saved $5,000 annually.

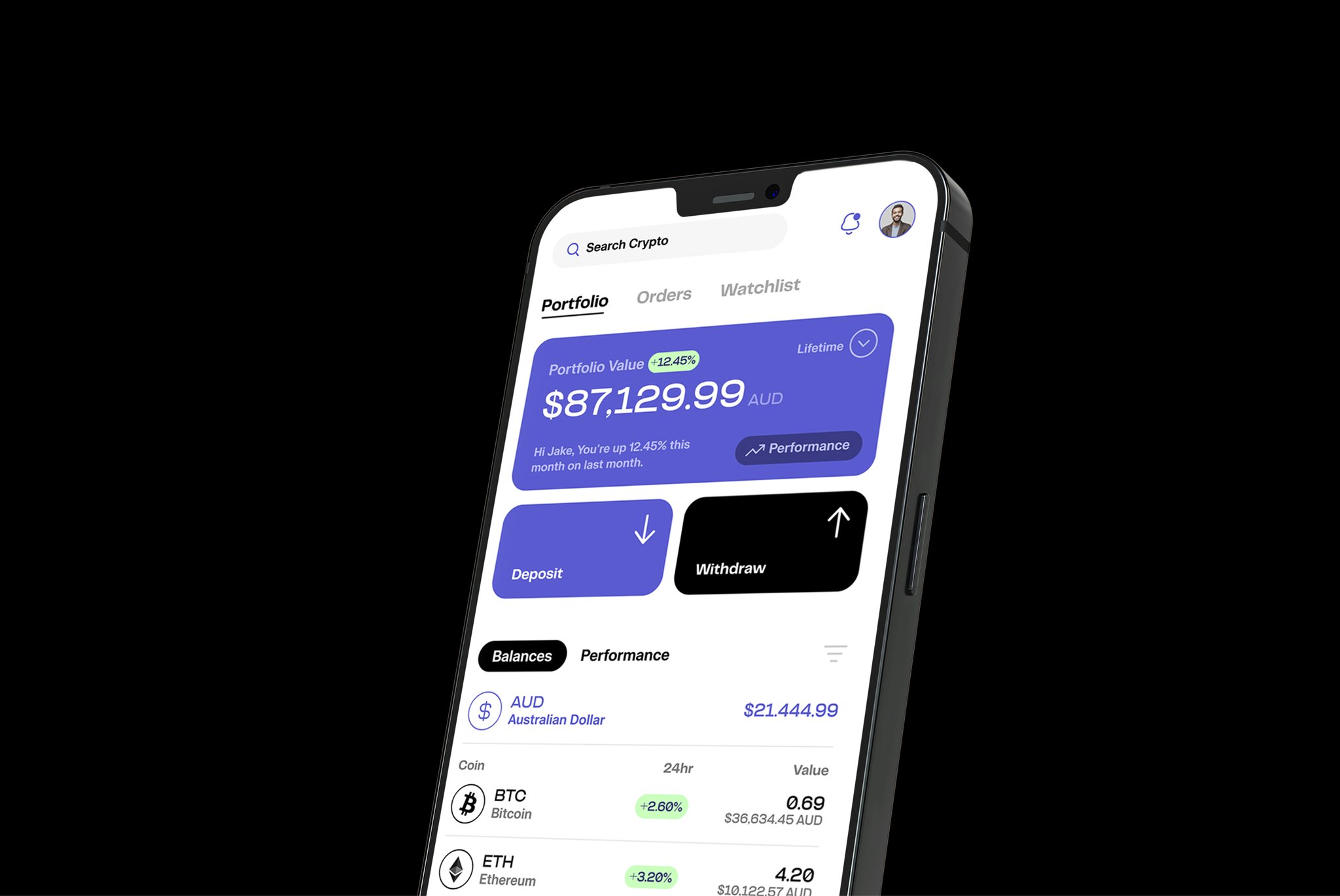

And then there’s Jake, whose love language is Taco Tuesday. Goodbudget helped him track his taco habit while setting aside cash for emergencies. Now he has both tacos AND peace of mind.

Frequently Asked Questions

Are All Expense Tracking Apps Mobile-Friendly?

Most modern apps work across devices, but check compatibility before diving in. Nobody likes squinting at tiny fonts.

Will These Apps Work With My Bank?

Many popular trackers sync seamlessly with big banks, but smaller credit unions may require workarounds. Always verify!

Do I Really Need Premium Features?

Honestly? Maybe not. Free plans often cover basic functionality. Upgrade when YOU decide it’s worth it.

Conclusion

So there you have it—the lowdown on making an expense tracking app your new favorite sidekick. From budgeting course graduates to financial newbies alike, mastering expense management unlocks doors to a brighter future.

Remember, tech alone won’t fix bad habits—but coupled with smart strategies, it’s unstoppable. Cheers to better spending decisions—and fewer mysterious bank charges!

—

Dream big, budget bigger.

Like Pikachu hunting Pokémon, chase those savings relentlessly.

Beep boop. End transmission.